The Ukraine conflict has been raging for more than a month now and has increased uncertainty in the near term. Consumers are already struggling with high inflation, which has led to a steady and gradual erosion of their purchasing power.

GLOBAL MACRO: A COLD WAR IN THE MAKING?

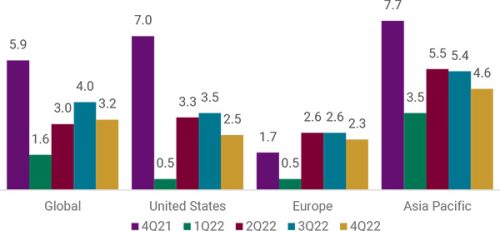

The Ukraine conflict has been raging for more than a month now and has increased uncertainty in the near term. Consumers are already struggling with high inflation, which has led to a steady and gradual erosion of their purchasing power. As a result, global growth estimates are at risk of more downgrades. The Fed has reduced the US GDP growth forecast for 2022 from 4% to 2.8%. Although this is still above the expected potential growth, the anticipated interest rate hikes during the year could further weaken consumer confidence. Nevertheless, we believe it is too early to worry about stagflation. Previous periods of stagflation resulted from high oil prices emanating from an oil supply shock and those periods were also recessionary. But the global economy is still expected to grow this year though lower than earlier envisaged. However, the long-term consequences of the war could be enormous. We may be at the

beginning of a new bloc formation or a new Cold War between western liberals and closed autocracies. Widening differences could drive protectionism for national security considerations at the expense of economic efficiencies.

A recession is not anticipated this year or next Real GDP growth forecasts YoY %

Source: JP Morgan, LGT

GLOBAL EQUITIES: OUTSTANDING COMEBACK

When the Russia-Ukraine war ends is pure speculation, but capital markets have built up a specific immunity to the headline risks in the last few weeks. Equities rallied and outperformed fixed income after the US Fed hiked its policy rate by 25 bps as telegraphed. Although the war pushed up inflationary expectations and pulled down growth estimates, global recession risks remain low due to Omicron re-opening. Economic momentum is expected to continue, and many nations will still grow above potential, but risks to corporate earnings are skewed to the downside. Historical data also suggests equities perform well once inflation peaks which it is likely to by the mid of 2022. An energy supply shock has severe consequences to Europe’s economic outlook. For this reason, we had downgraded European equities, which we did not have high conviction in the first place. China’s zero-Covid policy has led to strict lockdowns in Shanghai to control renewed surge in infections which could hamper recovery and disrupt supplies of critical goods. We retain our tactical OW stance on the US and Japan and UW on Europe, Asia ex-Japan and EM ex-Asia.

Market has a habit of shrugging off geopolitical events

Note: 1d performance is calculated as T-1 to T+1

Source: Bloomberg, UBS, LGT

GLOBAL FIXED INCOME: YIELD CURVE INVERSION IS A NON-ISSUE; OW HY

The US 2-year yield moved above the 10-year yield leading to a momentary yield curve inversion and opening debate around a likely recession. We believe the curve is responding to Fed’s aggressive rate hike guidance and faster balance sheet reduction (USD 95bn/month), which anchors the short end. In addition, the ECB brought forward its timeline for ending Quantitative Easing, paving the way for its hike in 2H22. Though China’s liquidity conditions are improving, the pace of monetary easing is slower than the central bank commentary. On the other hand, BoJ is tightening its liquidity conditions slightly and phasing out its ultra-easy monetary policy. However, the BoJ is vowing to defend its yield cap against the global tide of higher interest rates by offering to buy infinite amounts of 10-year Japanese government bonds, leading to a sharp sell-off in the yen. Retain OW on HY relative to IG and Sovereign bonds, but as HY spreads have narrowed sharply, investors could look at low beta long-short equity funds and zero beta market neutral products.

There is a significant time gap between curve inversion and recession

*Note: The S&P500 returned +27% from 4Q05 to the ultimate cycle peak in 4Q07

Source: Bloomberg, LGT

GLOBAL COMMODITIES: VOLATILITY TO STAY; OW GOLD

In the wake of Russia’s invasion of Ukraine, wild swings in commodity prices are here to stay, as global supply chains are getting reassessed. Russia being the critical supplier of various commodities to EU, imposing sanctions on Russia will not be easy. Adding to the woes are the fresh lockdowns in China with estimates suggesting 193 mn people are currently under mobility restrictions that contribute to RMB 23 trillion of GDP. As a result, coking coal prices crashed overnight by ~15% and are down ~40% from the peaks. Oil is on a roller coaster as prices react sharply to daily events. After rallying last month and touching a high of USD 2,050, Gold has remained in a range. We retain our OW stance on Gold as a hedge against inflation and near-term uncertainty.

Agriculture inflation is the next thing

Source: Bloomberg

INDIA MACRO: UPSIDE RISKS TO INFLATION AND DOWNSIDE RISKS TO GROWTH

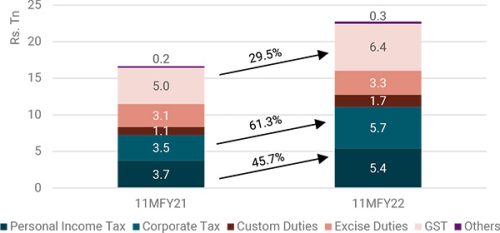

India’s GDP forecasts for FY22-23 have been downgraded by 0.5% to 1% due to persisting concerns around higher crude oil and commodity prices and disruptions in business operations due to the Russia-Ukraine conflict. In FY22, India’s trade deficit, exports, and imports reached all-time highs. A 42% growth in FY22 allowed exports to surpass the USD 400 billion target, led by engineering goods, petroleum products, and gems and jewellery. Imports grew 55% in FY22, primarily driven by crude and crude products, electronics, and Gold. On the revenue front, tax buoyancy continues to support government revenues, with direct tax collections for 11MFY22 surging 53% YoY, contributed by a sharp increase in personal and corporate income tax collections. Meanwhile, indirect tax collections grew 23% YoY in 11MFY22, led by robust GST collections and higher customs and excise duties. However, the government failed to meet even its downward revised disinvestment target of INR 780bn for FY22 by a wide margin, as the market volatility induced by the Russia-Ukraine conflict forced them to defer the long-awaited LIC IPO to FY23.

Domestic air and rail passenger bookings have revived strongly, with travel restrictions being lifted around the country. Google mobility indicators also suggest that movement is now comfortably above pre-Covid levels. Composite PMI Index came in at 54.3 in Mar-22, led by service providers, while growth by manufacturers slowed down slightly to 6-month lows. Auto OEM Volumes in Mar-22 showed a mixed trend on a YoY basis, with sustained positive momentum in PVs and CVs, while 2Ws and Tractors posted weaker sales.

Tax buoyancy has supported government revenues as disinvestments yet did not meet revised estimates

Source: CMIE

India’s CPI basket is heavily tilted towards Food items

Source: Bloomberg

INDIA EQUITIES: NEGATIVES PRICED IN; RAISE OW ON EQUITY; STAY OW LARGE

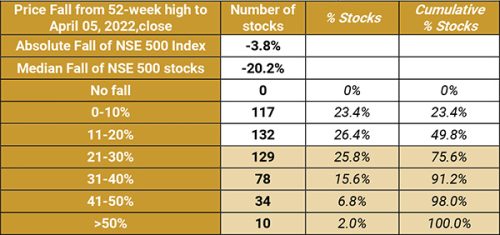

India Equities have climbed the wall of worries that were present at the start of Mar-22 – Russia Ukraine war, FII selling, US Fed meeting, state election outcomes – resulting in a strong rebound from the lows. We believe spiraling energy and commodity prices will pressure margins and drive earnings downgrades in the upcoming results season. Despite that, benchmark index EPS could grow at a healthy 12-15% CAGR over the next two years. Equities could then be expected to provide returns in-line with EPS growth in a scenario of no valuation re-rating. Relatively, this return would still be higher than what fixed income can provide at the current juncture. Also, bond yields are at greater risk from higher inflation and slower growth than Equities. Though the absolute fall at the Index level appears modest, many stocks have corrected sharply, leading to huge underperformance. Valuations for a few sectors are even closer to 5-year averages which could mean revert in the medium term. VIX Index has moderated from the peaks, but episodes of risk aversion could occur, which should be leveraged to build long-term portfolios. Investors could spread their allocations in two to three tranches in lieu of SIPs or STPs to achieve their target allocations in Equities in the ongoing market volatility. We further raise our tactical OW stance on Equity vs Bonds and retain OW on Large vs Mid-caps.

Stock picking time: 50% of the Nifty 500 constituents are down more than 20% from their 52-week highs

Source: ACE Equity

INDIA FIXED INCOME: DISCOMFORTING INFLATION; OW CORP AND SHORT TERM

The factors that aid monetary policy decisions have substantially changed from RBI’s last meeting in Feb-22. Inflation is likely to breach the upper tolerance limit by quite a margin in the coming months, driven primarily by fuel and related items. On the other hand, growth is expected to come in lower than guidance, led by global supply chain disruptions and domestic demand distortions due to rising input prices. Additionally, global central banks have already moved ahead by hiking rates to tame inflation, resulting in a spillover effect. In the Feb-22 policy, an MPC member had also pitched for a change in stance to Neutral, saying the continued focus on the pandemic fight had become counterproductive. As a result, the ongoing Apr-22 meeting holds significance as we will get to know if RBI changes its tune or not. The 1HFY23 borrowing calendar at 60% of the whole year is in-line with historical trends. Still, it could be at risk of increasing if subsidy financing or social welfare spending takes precedence over capex given the recent developments. Though corporate bonds spreads have narrowed to unattractive levels, heavy supply and liquidity concerns weigh on G-Secs. We prefer good-quality Corporate Bonds / Funds adopting a barbell investment strategy to address volatility and duration risk.

Going into FY23, high inflation, liquidity tapering, and fiscal deficit concerns would keep pressure on bonds, especially G-Secs.

Government’s 1HFY23 borrowings skewed towards the long end

Source: RBI

CURRENCY: OVER-ARCHING FED OFFERS SAFE-HAVEN CARRY YIELD

Should the age-old tenet of interest rate parity prevail over the long run, the INR should henceforth appreciate vs the USD as the latter’s inflation is now through the roof at 7.9% for Feb-22. Yield curve inversions are now being accompanied by inflation differential inversions as well. However, fast rises are generally followed by quicker falls and consequently, inflation in the U.S. would likely be perceived as a short-term carry trade instead. In a battle of central bank balance sheets, the RBI is preparing to fight off the goliath Fed’s tightening by selling some foreign reserves. India’s REER has (surprisingly) weakened only marginally in Mar-22 amidst the Russia-Ukraine war. MIFOR has not seen that much of a hardening vs. the LIBOR and in the future, this could also spur some depreciation of the INR. Net-net, we maintain our OW on USD.

MIFOR has hardened only 65bps in Mar-22 vs. 92bps for LIBOR

Source: Bloomberg

TACTICAL ASSET ALLOCATION (TAA) VIEWS & PERFORMANCE

Source: Bloomberg. Assuming a 6% annualized yield for cash.

GLOBAL ASSET PERFORMANCE SNAPSHOT

Source: Bloomberg Equity/Fixed Income Returns/Yields in local currencies. Commodities in USD. Numbers for Fixed Income are Yields. As of March 31, 2022.

ROUTES TO MARKETS: MODEL ALLOCATIONS