July was a momentous month for all global citizens (or only for the wealthy, as some may argue) as space travel inched closer to becoming a commercial reality.

GLOBAL MACRO: LEARNING TO LIVE WITH THE VIRUS

July was a momentous month for all global citizens (or only for the wealthy, as some may argue) as space travel inched closer to becoming a commercial reality. Human ingenuity has shown that nothing is impossible. And the timing of this feat could not be better as it further raises our hope to triumph over the pandemic despair. Delta variant has led to a sharp rise in cases in US and Asia, increasing concerns if recovery will be bumpier than expected. SE Asia’s slower pace of vaccinations has begun to paralyze the region’s economy after successfully managing to keep the virus in check last year. China’s growth has likely peaked with industrial production, retail sales, and construction coming in below the 3-year average. Japan’s mobility restrictions led to disappointing economic data. UK seems to have passed its “Freedom Day” acid test as herd immunity played out and cases halved from the peak. PMI data showed recovery is gathering pace in Eurozone. But inflation has been surprising on the higher side across markets which could dent sentiments a bit. We wish the Olympic motto “Citius, Altius, Fortius” has a rub-off effect on the whole world.

US and Europe lead when it comes to number of people vaccinated

Source: Our World In Data; Top 10 countries based on daily confirmed cases

GLOBAL EQUITIES: A MIX OF HIGHS AND LOWS

Chinese authorities intensified their regulatory clampdown on tech sector by imposing a surprise ban on for-profit after-school tutoring – essentially shutting down USD 100bn edu-tech sector – and restricting the use of VIE structure. It came close on the heels of cybersecurity investigations of ride-hailing app DiDi, imposition of fines on e-commerce companies, and increased scrutiny of overseas IPOs. The government has also taken action to stabilize the housing market. These events, in turn, triggered volatility leading to the carnage in China and HK equities. Such moves could now add a permanent “risk premium” to Chinese investments. Covid resurgence concerns dragged down Japanese equities too. DMs in the West, though, were stable or making new highs. Of the US S&P 500 companies that have reported, ~90% beat analyst estimates, taking the index to all-time highs, despite US VIX spiking by 30% MoM and June quarter GDP annualised growth coming at 6.5%, i.e., 2% below consensus.

We retain our tactical OW stance on EU/Japan (Cyclical and Value) and stay Neutral US. Investors can build some cash position, by going UW on Asia ex- Japan and EM, to buy into cheaper valuations down the road.

China under pressure from recent regulatory crackdown

Source: Bloomberg; *As of 31st July 2021

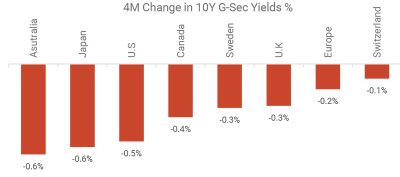

GLOBAL FIXED INCOME: MOVING CLOSER TO TAPERING; OW HIGH YIELD

At its July meeting, the US Fed recognised that though the economy has progressed toward its goals, this progress was not “substantial” yet. Labour market recovery picked up pace as 850,000 jobs got added in June. So, while tapering of asset purchases could happen later this year or earlier next year, rate hikes are off the table for now, even as inflation continues to surprise for the fourth consecutive month. The Bank of Canada, US’s neighbour up north, is more optimistic about the speed of recovery of the Canadian economic block. It took another big step to reign in emergency stimulus levels by further tapering weekly purchases by one-third to C$ 2bn. BOC is one of the most hawkish banks amongst advanced economies, which has also guided a hike in 2HCY22. The Bank of New Zealand halted bond-buying in July (no taper, just a full stop!) by stating that a “least regrets” policy suggested withdrawal of support. We do retain our OW on HY relative to IG and Sovereign bonds, but given that HY spreads have narrowed sharply, investors could look at low beta long-short equity funds and zero beta market neutral products as well.

DM 10-year sovereign yields have retraced their earlier spikes

Source: Bloomberg; *As on 31st July 2021

GLOBAL COMMODITIES: GOLD CREATES OPPORTUNITY FROM RISK

Much of the commodity basket enjoyed another excellent month in Jul-21, barring Corn and Soybean. For Gold, interest rates will likely remain a key driver in the short and medium term. Gold prices typically show a much stronger inverse relationship with TIPS yields. 10Y TIPS yields change over the last 6m has turned negative (-14bps). There has also been sharp rise in net contracts, negative yielding debt, and US VIX. Thus, Gold can act as a hedge against spiking inflation and volatility. We turn Overweight on Gold from Neutral.

Inverse Relationship Between TIPS∆ and Gold

Source: Bloomberg

INDIA MACRO: AN UNEVEN RECOVERY

With only 7.9% of the population fully vaccinated, the inoculation drive has been slower than expected, and the impending 3rd wave risk looks increasingly daunting. NITI Aayog expects to see around 15 crore vaccinations in Aug-21, significantly lower than the previous 25 crore target set in May. Domestic manufacturers cannot ramp up production to ideal levels, and there are no further breakthroughs for India in importing vaccines. The 2nd wave of carnage was dampening for MSMEs, particularly in the services sector and the informal economy. At the same time, corporates in specific beneficiary sectors deleveraged their books as they could generate healthy cash from operations. Top companies in these sectors have also seen capacity utilisation inching up to levels compelling them to expand. Some bankers opine that India is at the cusp of a multi-year capex cycle. Private and public sector units are likely to accelerate spending to benefit from ~USD 350bn of government orders expected to be awarded in the next two years.

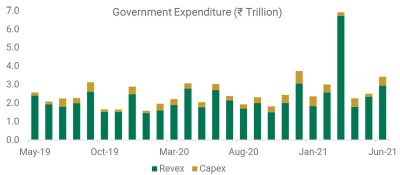

India’s Manufacturing PMI rose to 55.3 in Jul-21, aided by a marginal increase in manufacturing employment, ending a 15-month streak of job losses and an uptick in total order books. However, Services PMI at 45.4 offset the rebound in manufacturing, with further contractions in private sector sales, output, and employment. GST collections improved to INR 1.16tn with the resumption of economic activity and easing Covid-19 restrictions, which should aid government spending to revive economic growth. Auto sales for Jul-21 saw a good increase from PVs despite high fuel prices, underpinning the sustained demand for personal mobility over public transport and is likely to continue until the festive season. India’s exports were a record USD 35.2bn in Jul-21, while

imports increased to the second highest ever, USD 46.4bn, widening the trade deficit to USD 11.2bn. Monsoons were 2% below Normal as per latest reading.

Jul-21 exports at record monthly high of USD 35bn (+48% YoY)

Source: Bloomberg; PTI

Government spending is inching up MoM with CapEx growth > RevEx

Source: CGA

INDIA EQUITIES: DAWN OF A NEW ERA; STAY OW EQUITY / RETAIN OW MID

Jul-21 will be etched forever in history as a coming-of-age month for Indian equity markets. Long-term concerns around PE/VC exits from investee Internet unicorns were laid to rest, with Zomato’s IPO sailing through smoothly. Despite successive annual losses and less visibility on immediate profitability, the INR 94bn issue was oversubscribed ~40x. A handsome pop on the listing was the cherry on top. Peer tech startups – Paytm, Policybazaar, Mobikwik, Nykaa, CarTrade – have lined up their offerings to cash in on the sentiments. Many more will come, but it would be prudent for investors to focus on fundamentals instead of giving in to FOMO. On the other hand, large-cap Nifty was in a tight range, and swift sector rotation was at play. Mid and Small piled on to their vast outperformance. June quarter numbers so far have been either in-line or better than expected, with minor disappointment. Investors wary of taking tactical OW equity exposure at this juncture can execute a derivative-based portfolio hedging strategy instead of booking gains and moving to cash.

Though India’s premium to EM rose sharply last month and FIIs turned net sellers, we retain OW on Equity vs. Bonds primarily driven by low VIX, robust DII flows (MFs and non-MFs), SIP flows, and negative real yields, and healthy EPS growth. We raise conviction by a notch on our OW view on Mid vs. Large caps led by relatively better valuations, higher forward EPS upgrades, and technical momentum indicators. Investors can take satellite positions in short- term thematic opportunities with a 6-12-month view.

Large Cap Nifty 100 in consolidation phase for last 2 months

Source: Bloomberg; Performance rebased to 100 on 31-Dec-2019

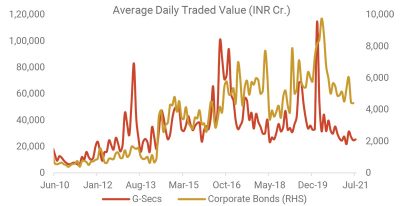

INDIA FIXED INCOME: STRIKING A BALANCE; OW CORP / SHORT TERM

After surprising on the upside in June, headline CPI came in below estimates at 6.26% in July. While CPI has remained above the 6% upper bound for two months, it is likely due to supply-side factors, allowing RBI to retain its growth supportive stance until there are signs of a sustainable recovery. Mr. Das too hinted at the same in a recent media interview. But slight upward revision to the FY22 CPI forecast of 5.1% could be expected at the 06-Aug-21 MPC meeting. GDP forecast is likely to be retained at 9.5% with downside risks from a potential third wave and a prolonged recovery, particularly in the services sector and informal economy. RBI announced a cut-off yield for the new 10-year 2031 G- Sec at 6.1%, indicating slight tolerance for higher yields, thus, ending its tussle with market participants. Earlier 10-year benchmark had become highly illiquid, with the central bank buying almost 80% of the bonds in circulation. We like top- quality corporate issuances/funds and short-duration investments for debt allocations while avoiding G-Secs and the long end of the curve.

Debt market activity on a downtrend

Source: Bloomberg, CCIL

CURRENCY: FLOWS TO PROP THE INR, POTENTIAL CARRY FAVOURS USD

For Jul-21, the INR and the USD had an even-stevens contest with see-sawing sentiments. Net in-flows mainly from FIIs into the primary (IPO-driven) equity markets should strengthen the INR. Former New York Fed President William Dudley commented that the central bank might not announce tapering until Nov- 21 or Dec-21. Much has likely been priced into now, falling U.S. 10-year as well as the recently seen flight away from USD. In the future, this could reverse as market participants anticipate some form of Fed tightening and hence some carry return from the greenback. Retain Neutral on USD-INR currency pair.

FII inflows should remain strong thanks to multiple IPOs

Source: Bloomberg

TACTICAL ASSET ALLOCATION (TAA) VIEWS & PERFORMANCE

Source: Bloomberg. Assuming a 6% annualized yield for cash.

GLOBAL ASSET PERFORMANCE SNAPSHOT

Source: Bloomberg Equity/Fixed Income Returns/Yields in local currencies. Commodities in USD. Numbers for Fixed Income are Yields. As of 31 st July 2021.

ROUTES TO MARKETS: MODEL ALLOCATIONS