2021 ended on a low note and with the same headline issues prevalent in 2020; just one difference – virus variant.

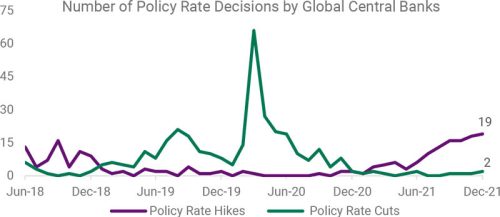

GLOBAL MACRO: OMICRON IS HIGHLY INFECTIOUS BUT LESS LETHAL

2021 ended on a low note and with the same headline issues prevalent in 2020; just one difference – virus variant. Relative to Delta, Omicron is spreading more rapidly, also driven by seasonality, but is turning out to be much milder, with cases majorly asymptomatic and less than 1% requiring ventilator support. With daily infections making newer highs, mobility restrictions have come back, taking some sheen off the recovery seen in services. However, as seen in the PMI and industrial production data, manufacturing has stayed buoyant, despite rising input prices and supply constraints. An immediate concern is pressure on health infrastructure in several countries as medical staff are affected. With Omicron sweeping through the masses, two scenarios could unfold 1) the pandemic ends and becomes endemic, or 2) newer and much lethal variant crops up. Boosters and anti-viral pills will play a key role as we begin the New Year. Eventually, the focus will shift to the pre-Covid era matters around persistent inflation and tightening fiscal and monetary policies.

All over again: Daily cases hitting record highs led by Omicron

Source: Our World in Data; 7DMA: 7-Days Moving Average

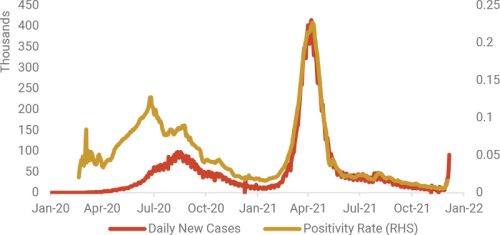

GLOBAL FIXED INCOME: BITING THE BULLET; OW HIGH YIELD

In a complete U-turn of sorts, 3 of the 4 DM central banks sounded cautious around unabated inflation than economic disruption from Omicron. With CPI readings at multi-decade highs and unemployment falling closer to pre-pandemic levels, all bank Governors acted or guided towards rate hikes. US Fed accelerated tapering from USD 15bn to 30bn with the FOMC plotting three median hikes in 2022. Mid-term elections in the US could play a role here. ECB also confirmed that PEPP would end by Mar-22 with asset purchases shrinking every quarter after that. BOE was the first G7 central bank to go ahead and raise rates by 0.15% to 0.25% as the UK retail price index reported 7.1% growth (higher than the official 5.1% CPI reading), and job vacancies rose to 1.2mn in a sign of labour market tightness. PBOC is moving in the opposite direction as it is turning cautiously expansionary by easing RRR and lending rates to address downside risks to growth. Retain OW on HY relative to IG and Sovereign bonds, but as HY spreads have narrowed sharply, investors could look at low beta long-short equity funds and zero beta market neutral products.

Equity (Risk) Investors earned healthy returns, except from EM

Source: Bloomberg

GLOBAL COMMODITIES: STRONG 2021-BENIGN 2022; RAISE OW GOLD

2021 turned out to be excellent for Commodities, with S&P GSCI Index gaining 37%. With easing supply constraints, commodities prices are expected to be soft in 2022 but still likely to be higher than the 5-year averages supported by macro-economy and low inventory. The global Oil market could move back into surplus driven by solid supply growth from non-OPEC nations and a further easing in OPEC+ supply. The aluminum market is heading into a period of structural deficits with high energy prices leading to curtailment of production across the mines. There is no quick fix to resolve this. DXY and interest rates trending higher could hurt Gold, but valuations, inflation, and technical momentum indicators (trading above the 200 DMA) provide support. Thus, we raise our tactical Overweight stance on Gold.

Global central banks are pivoting towards rate hikes to address inflation

Source: cbrates

INDIA MACRO: COVID 3RD WAVE LOOKS TO BE RELATIVELY LESS PAINFUL

India is witnessing an exponential increase in daily infections and rising positivity rates, driven majorly by the Omicron variant. However, the public perception has not reached the panic stage due to the seemingly milder symptoms and shorter recovery period of this variant. Nevertheless, the testing and vaccination rates now need to be stepped up to prevent further transmission, while the government plan is underway to deliver booster shots and target the newly eligible 15- to 17-year-olds. FD for Apr-Nov 2021 was 46% of FY22 BE, supported by robust tax revenues and controlled expenditures. However, the government is unlikely to meet its disinvestment targets for FY22, with several big-ticket deals far from completion. Even as narrow FD looks like a prudent step in the right direction, the risk is undershooting on growth as the contribution from the government component is suppressed. On the trade front, India’s merchandise exports for 9MFY22 were reported at nearly USD 300bn, almost 49% higher than the same period in FY21, and on track to achieve the annual target of USD 400bn by Mar-22. All eyes will now be on the Union budget for FY23 for its sectoral spending allocations and new growth triggers.

India’s Composite PMI declined from 59.2 in Nov-21 to 56.3 in Dec-21, as manufacturing production and services activity increased at slower rates. GST collections increased nearly 13% YoY in Dec-21 and stayed above INR 1tn for the sixth consecutive month. However, certain restrictions on contact-sensitive sectors and services imposed by the third wave could compress collections for the last quarter of the fiscal year. Google mobility indicators in Dec-21 were higher than pre-Covid levels; however, we may see a dip in mobility in the next few weeks with localized curfews now coming back.

2021 was a boom year for all commodities except precious metals

Source: Bloomberg; Data series rebased to 100

INDIA EQUITIES: SPOTLIGHT ON EARNINGS; TURN OW ON EQUITY AND LARGE

Indian indices capitulated on Omicron doubts exacerbated by FII selling through most of Dec-21. But then, in line with global equities, they rose like a phoenix from the ashes to close the month in green. CY21 was an excellent year for India Equities especially relative to MSCI EM, which suffered due to Chinese regulatory crackdowns. This had a positive rub-off on primary markets, with IPOs raising record capital of ~USD 16bn, far exceeding the amounts of the last two bull years – 2007 and 2017. New Year too began with a bang as markets posted gains in successive sessions. CY22 is also expected to be good led by strengthening macro, solid corporate performance, and domestic investor support. Index returns are likely to track earnings closely as multiple re-rating potential is minimal. But gains can be extracted from stocks and sectors which are undervalued and poised for growth. Turbulence from the upcoming Budget, key state elections, and monetary tightening could offer good entry opportunities for portfolio construction. We are returning to our tactical OW stance on Equity vs. Bonds on markets discounting Omicron’s fears and deriving confidence from improving macro-outlook and healthy EPS growth. We are also turning OW on Large-caps vs. Mid-caps as relative valuations are looking better for Large along with technical momentum. Investors can take satellite positions in short-term thematic prospects with a 6-12-month view.

Covid 3rd wave: Daily cases are surging rapidly, unlike in past

Source: Bloomberg

PMI moderated a bit but stayed in the expansion zone in Dec-21

Source: Bloomberg

INDIA FIXED INCOME: ABSORPTION OF LIQUIDITY; OW CORP

At the Dec-21 MPC meeting, RBI held on to policy rates and accommodative stance citing “conducive policy settings are needed to nurture economic recovery, that, though gaining traction, has just reached pre-pandemic levels.” RBI is waiting for private investment to lead the revival and a strong impetus from exports. The MPC also left its FY22 real GDP growth and CPI forecast unchanged at 9.5% and 5.3%, respectively. However, MPC does consider risks to the growth outlook emanating from a resurgence in Covid infections, persisting shortages & bottlenecks, the different policy actions across the world due to high inflation, and hardening global financial conditions. Expectedly, RBI further expanded fortnightly VRRR limits – rising to INR 7.5tn by 31-Dec-21 and, from Jan-22, liquidity absorption will be mainly undertaken through the auction route. These actions have had the same impact as reverse repo rate hikes as weighted average overnight rates have already inched closer to the repo rate. Given that yield curve flattening is led by rising front-end rates, we prefer top-quality corporate issuances/funds adopting a barbell investment strategy to address volatility and duration risk. We retain our tactical UW stance on G-Secs due to concerns around elevated supply.

Massive DII inflows helped offset lower FII buying in CY21

Source: Bloomberg

CURRENCY: SCALES TIPPED EVENLY FOR THE USD AND THE INR

India’s REER strengthened significantly in Dec-21. This ties in with the disparity in interbank lending rates within India and abroad. While LIBOR has shown a significant hardening recently, the same is not reflected in MIFOR. Consequently, INR/USD has numerically decreased, implying a strengthening of the INR, which transpired, looking at India’s real FX rate performing well against its currency basket. However, such firmness in MIFOR can arguably be justified as unreasonable as, at some point, the RBI may also tighten – already seen in particular longer-dated OIS tenures. The MPC has maintained its stance of policy support in its Dec-21 meet and minutes. Hence, net-net, we turn neutral on USD/INR pair.

RBI focused on draining abnormally high liquidity before hiking rates

Source: Bloomberg

CURRENCY: GREENBACK LOOKING “GREEN”; RETAIN OW ON USD VS INR

EMs had a tough Nov-21 with Turkish President Erdogan again endorsing aggressive interest rate cuts despite widespread criticism and soaring inflation that led to a plummeting Lira. Inflation-wise, US CPI exceeded India’s for Oct-21 (6.2% vs 4.48% for India) and had done so in Sep-21 as well, making the USD an attractive source of carry. Further, US yields also rose after Joe Biden re-appointed Jerome Powell as Chairman of the Fed. The perception is that the Fed may start raising rates around mid-CY22 after tapering its bond purchases. Net-net, we remain OW on USD, keeping cognizance of other recent developments, such as any potential demand fears from Omicron and the efficacy of a US-led release of oil from strategic reserves.

MIFOR for India is stable, though LIBOR has shot up – MIFOR path ahead depends on Fed tightening rub-off vs. RBI’s policy

Source: Bloomberg

TACTICAL ASSET ALLOCATION (TAA) VIEWS & PERFORMANCE

Source: Bloomberg. Assuming a 6% annualized yield for cash.

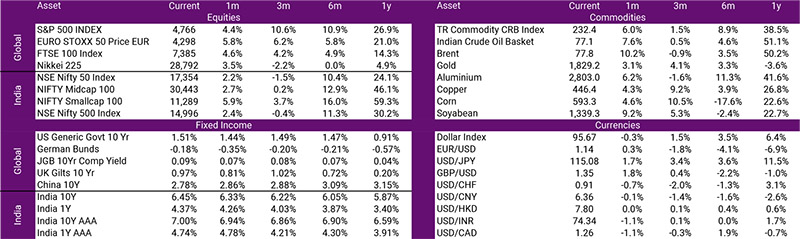

GLOBAL ASSET PERFORMANCE SNAPSHOT

Source: Bloomberg Equity/Fixed Income Returns/Yields in local currencies. Commodities in USD. Numbers for Fixed Income are Yields. As of December 31, 2021.

ROUTES TO MARKETS: MODEL ALLOCATIONS

Glossary: PMI: Purchasing Manager’s Index; GDP: Gross Domestic Product; EM: Emerging Markets; DM: Developed Markets; EU: European Union; CPI: Consumer Price Index; PCE: Personal Consumption Expenditures; COVID-19: Corona Virus Disease; EPS: Earnings Per Share; U.S.: United States; UK: United Kingdom; O(U)W: Over (Under) Weight; HY: High Yield; IG: Investment Grade; OPEC: Organization of Petroleum Exporting Countries; ETF: Exchange Traded Fund; GFCF: Global Fixed Capital Formation; OEM: Original Equipment Manufacturer; PV: Passenger Vehicle; CV: Commercial Vehicle; GST: Goods and Service Tax; G-Sec: Government Securities; PLI: Production Linked Incentives; RBI: Reserve Bank of India; YoY: Year on Year; MoM: Month on Month; OMO: Open Market Operations; MSCI: Morgan Stanley Capital International; USD: United States Dollar; INR: Indian Rupee; FX: Foreign Exchange; IPO: Initial Public Offering; ST: Short Term; FII: Foreign Institutional Investor; FDI: Foreign Direct Investment; LEF: Large Exposure Framework; MIFOR: Mumbai Interbank Forward Offer Rate