Just as the world was reopening at full speed, the emergence of a highly mutated variant – first detected in South Africa, named Omicron, and classified a VoC by WHO – could throw a spanner in the wheels.

GLOBAL MACRO: NEW VARIANT COULD BE A THREAT TO RISING OPTIMISM

Just as the world was reopening at full speed, the emergence of a highly mutated variant – first detected in South Africa, named Omicron, and classified a VoC by WHO – could throw a spanner in the wheels. Anecdotal evidence suggests Omicron is more transmissible than the Delta variant, but scientific data around its severity and immune escape is yet to come. Nevertheless, drug companies seem confident of producing new vaccines within three months, and antiviral pills could also help bend the infection curve if it comes to that. Delta has led to an ongoing fourth wave in Europe, accompanied by rising ICU admissions and mobility restrictions, especially in Northern Europe. On the macro front, PMI, retail sales, exports, and industrial production data are indicating robust growth recovery in general. Within EMs, China has bounced back from the last quarter’s trough, as seen from improvement in external demand and domestic activity. But Brazil has entered a technical recession – GDP de-growth in two consecutive quarters – driven by drought, inflation, and interest rates. Winter is coming, no doubt, but countries have adapted to the pandemic quirks and look better prepared to endure the pain this time around.

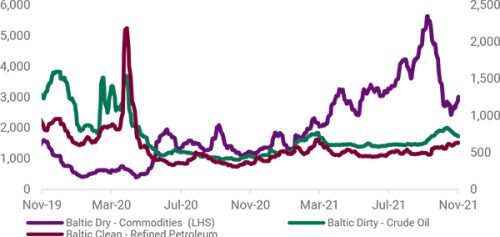

Normalisation of supply chains taking place as seen in Baltic indices

Source: Bloomberg

GLOBAL EQUITIES: OMICR-ON, RISK-OFF

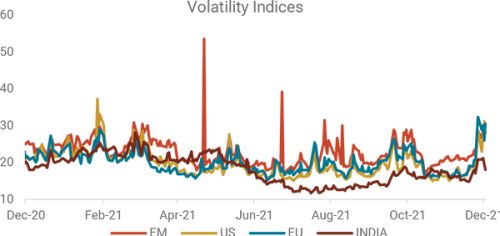

Global equities scaled new peaks in Nov-21 but nosedived on the Omicron- induced volatility. Since indices had their worst single day drop of 2021, Black Friday could be called Red Friday. As an event that had shifted to the bottom of the anticipated risks list came to the fore, Citi Global Risk indices, VIX indices (doubling MoM), and EMBI spreads spiked sharply. Market participants quickly shifted the capital to safe-haven sovereign bonds and currencies, making Equities (being risk-assets) shoulder much of the pain. “When in doubt, sell first and ask questions later” seems to be the strategy adopted to deal with the new ambiguity on the plate. Biden said that the new variant is a cause for concern but not to panic. Such turbulent episodes should be considered opportunities to build strategic offshore equity allocations. US macro and micro- level data are turning out to be better than expected relative to Europe. Thus, we have now taken a tactical OW stance on the US, continued with OW on Japan but moved Europe to Neutral. Asia ex-Japan and EMs are least preferred.

VIX (Fear) Indices spiked sharply towards end-Nov on Omicron news

Source: Bloomberg

GLOBAL FIXED INCOME: HAWKISH SURPRISE; OW HIGH YIELD

Oct-21 US CPI came in at a three-decade high at 6.2%, making the re-appointed US Fed Chair Powell comment that inflation has turned out to be stubborn and “risks of higher inflation have moved up.” On the other hand, first-time applications for unemployment benefits have dropped to a 52-year low driven by stronger than expected economic recovery, consumer spending, and broad- based wage growth. At the Senate hearing, Powell mentioned considering a faster wind-down of the Fed’s bond-buying program at its upcoming mid-Dec- 21 meeting, a move that could open the doors to earlier interest rate hikes. Fed officials now have a balancing act to do given this situation of tension between the dual mandate of full employment and price stability with Omicron thrown into the mix. BOE held rates at its Nov-21 meeting. Retain OW on HY relative to IG and Sovereign bonds, but as HY spreads have narrowed sharply, investors could look at low beta long-short equity funds and zero beta market neutral products as well.

Markets are expecting US Fed to hike rates starting Jun-22

Source: Bloomberg

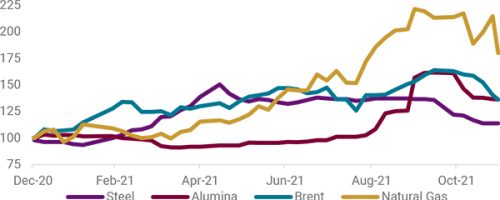

GLOBAL COMMODITIES: DEMAND CONCERNS IN FOCUS; RETAIN OW GOLD

Omicron spooked global commodities across the board in the last week of Nov- 21 Oil witnessed high volatility and dropped ~20% from the peaks. OPEC+, in a meeting on 02-Dec-21, agreed to add 400,000 barrels a day of crude to global markets in Jan-22 in a move that should please major consuming nations, especially the US. Domestic HRC steel prices declined further last week in the wake of subdued demand and threat of imports, although prices in China have started rising again on improvement in the real estate and infrastructure sector. The heightened uncertainty supports gold while other asset classes see money taken off the table to assess the real impact. Valuations relative to Copper / Silver also look attractive. Retain OW on Gold.

Commodity prices nosedived on demand likely getting impacted

Source: Bloomberg; Data series rebased to 100

INDIA MACRO: OMICRON A NEAR TERM RISK TO STEADY RECOVERY

A potential onslaught of the Omicron variant is prompting fresh concerns in the minds of citizens over the severity of the variant. Hence, the government’s focus on creation of awareness, mobilization, and vaccination of the eligible population yet to receive their first dose and the 120 million individuals still due for their second dose. While the door-to-door “Har Ghar Dastak” campaign has led to some growth in coverage, they must not get complacent and must tackle issues like vaccine hesitancy and wastage of vaccines. Indian economy grew 8.4% YoY in 2QFY22, facilitated by unlocking. Gross Fixed Capital Formation and Exports grew by 11% and 19% YoY, respectively, meaningfully higher than government expenditure and household consumption growth, which increased by 8.7% and 8.6%, respectively. The winter session of the Lok Sabha is ready to take center stage, with the spotlight on two landmark bills with significant consequences: The Cryptocurrency and Regulation of Official Digital Currency Bill and The Farm Laws Repeal Bill.

India’s Composite PMI rose from 58.7 in Oct-21 to 59.2 in Nov-21, signaling its most substantial upturn since Jan-21, led by growth in the manufacturing sector. GST collections increased 25% YoY to INR 1.3tn for the last month, on track to surpass BE for FY22. E-way bills issuance and Fast Tag toll collections continue to sight MoM growth. Google mobility indicators suggest just 6% short of normalcy in workplace resumptions. Auto OEMs, however, reported relatively weak numbers across segments in Nov-21, especially in CVs and tractors. Rising gold imports widened trade deficit to all-time high of USD 23.3bn. Rabi crop sowing is gathering pace, with ~55% of total area cultivated.

2QFY22 Real GDP at 8.4% met expectations; Nominal GDP at 18%

Source: Bloomberg

Nov-21 trade deficit at record high as exports growth lagged imports

Source: CMIE

INDIA EQUITIES: KNOCKED DOWN, BUT NOT OUT; TURN NEUTRAL ON EQUITY

Indian equities were crawling back up from the Oct-21 sell-off to be hit by two successive events. The first blow was domestic and came from an IPO debacle which listed at a massive 27% discount to issue price. The second blow came from the virus. India VIX also blasted through the roof in line with global indices, almost doubling from 12 to 24 in a week. FII’s had already turned cautious in Oct-21 due to global monetary tightening and stretched domestic valuations. Nov-21 saw the second highest FII net outflows from secondary markets at INR 400bn trailing the Mar-20 record of INR 660bn. FII selling could also be mere profit booking to capitalise on the large gains earned from Indian indices so far this year (Calendar effect) and Omicron happened to provide just the right reason to sell. Waning retail participation looks obvious with incremental mobility and return-to-office. We are turning tactically Neutral on Equities vs. Bonds driven by elevated VIX and FII selling, though DII support has managed to offset FII outflows to a great extent. Strategically, we still find Equities attractive due to improving macro-outlook and healthy EPS growth. We are also turning Neutral between Large-caps and Mid-caps as the relative valuations are now looking better for Large but technical indicators support Mid. Investors can take satellite positions in short-term thematic opportunities with a 6-12-month view.

Primary (IPO) market sucking FII liquidity from secondary

Source: Bloomberg

INDIA FIXED INCOME: SMALL JOY FOR SAVERS; OW CORP / SHORT TERM

Equity investors are having the best of times as they made good returns on their capital in the last two years. But conservative savers were at the losing end as they had to withstand the worst of RBI’s ultra-loose monetary policy, which led to abnormally low-interest rates on debt products like fixed deposits and the like. In other words, savers were subjected to financial repression. But now, ahead of the RBI’s meeting, India’s two leading NBFC’s, HDFC and Bajaj Finance, have hiked their long-term deposits rates. Deposit growth and money supply are inching up after a long time. We believe RBI could do reverse repo hikes in the Dec-21 policy, which could push up short end yields further higher, followed by a change in stance in Feb-22 before it embarks on the path of gradual repo hikes. Given the recent Omicron development and RBI’s growth focus, it seems the Governor would not like to disturb the apple cart and jeopardise the uneven economic recovery by announcing any drastic measures. The FD continued to surprise positively as it came in at just 36% of BE for the Apr-Oct-21 period, lowest in four years. Given that yield curve flattening is led by rising front-end rates, matching duration with investment horizon is vital for debt allocations. We prefer top-quality corporate issuances/funds and short-duration investments for debt allocations while avoiding G-Secs and long duration.

Short end yields are rising led by liquidity normalisation

Source: Bloomberg

CURRENCY: GREENBACK LOOKING “GREEN”; RETAIN OW ON USD VS INR

EMs had a tough Nov-21 with Turkish President Erdogan again endorsing aggressive interest rate cuts despite widespread criticism and soaring inflation that led to a plummeting Lira. Inflation-wise, US CPI exceeded India’s for Oct-21 (6.2% vs 4.48% for India) and had done so in Sep-21 as well, making the USD an attractive source of carry. Further, US yields also rose after Joe Biden re-appointed Jerome Powell as Chairman of the Fed. The perception is that the Fed may start raising rates around mid-CY22 after tapering its bond purchases. Net-net, we remain OW on USD, keeping cognizance of other recent developments, such as any potential demand fears from Omicron and the efficacy of a US-led release of oil from strategic reserves.

Rush to safe-haven USD drove weakness in Fragile 5 (EM) currencies

Source: Bloomberg

TACTICAL ASSET ALLOCATION (TAA) VIEWS & PERFORMANCE

Source: Bloomberg. Assuming a 6% annualized yield for cash.

GLOBAL ASSET PERFORMANCE SNAPSHOT

Source: Bloomberg Equity/Fixed Income Returns/Yields in local currencies. Commodities in USD. Numbers for Fixed Income are Yields. As of November 30, 2021.

ROUTES TO MARKETS: MODEL ALLOCATIONS

Glossary: PMI: Purchasing Manager’s Index; GDP: Gross Domestic Product; EM: Emerging Markets; DM: Developed Markets; EU: European Union; CPI: Consumer Price Index; PCE: Personal Consumption Expenditures; COVID-19: Corona Virus Disease; EPS: Earnings Per Share; U.S.: United States; UK: United Kingdom; O(U)W: Over (Under) Weight; HY: High Yield; IG: Investment Grade; OPEC: Organization of Petroleum Exporting Countries; ETF: Exchange Traded Fund; GFCF: Global Fixed Capital Formation; OEM: Original Equipment Manufacturer; PV: Passenger Vehicle; CV: Commercial Vehicle; GST: Goods and Service Tax; G-Sec: Government Securities; PLI: Production Linked Incentives; RBI: Reserve Bank of India; YoY: Year on Year; MoM: Month on Month; OMO: Open Market Operations; MSCI: Morgan Stanley Capital International; USD: United States Dollar; INR: Indian Rupee; FX: Foreign Exchange; IPO: Initial Public Offering; ST: Short Term; FII: Foreign Institutional Investor; FDI: Foreign Direct Investment; LEF: Large Exposure Framework; MIFOR: Mumbai Interbank Forward Offer Rate