Every

country has been walking on a tightrope doing a balancing act of saving lives

without damaging the economy. The focus has now slowly moved from public

healthcare and safety to economic recovery – from survival to revival – as

economies are slowly reopening. Search for a cure remains elusive even as

WHO and local medical institutions fight out on the efficacy of a specific drug

regimen, be it Remdesivir or HCQ. But all eyes are now on the 6 key vaccines

(chart besides) with the highest probability of success and the ability to

manufacture at scale. With re-election around the corner, Trump’s

anti-China rhetoric is again out in the open. Last time around he had the

support of a strong economy, but with highest post-war era unemployment and

civil unrest in his own backyard, the diplomatic twists and turns this time

around could be counter-productive, if not thought through a wider lens. With

so much pain and agony around, looking inward should be last on the minds. TIMES

CALL FOR PEOPLE TO COME TOGETHER AND MOVE FORWARD AS ONE.

UNLOCK

1.0: THE LONG AND HARD ROAD TO RECOVERY

Every

country has been walking on a tightrope doing a balancing act of saving lives

without damaging the economy. The focus has now slowly moved from public

healthcare and safety to economic recovery – from survival to revival – as

economies are slowly reopening. Search for a cure remains elusive even as

WHO and local medical institutions fight out on the efficacy of a specific drug

regimen, be it Remdesivir or HCQ. But all eyes are now on the 6 key vaccines

(chart besides) with the highest probability of success and the ability to

manufacture at scale. With re-election around the corner, Trump’s

anti-China rhetoric is again out in the open. Last time around he had the

support of a strong economy, but with highest post-war era unemployment and

civil unrest in his own backyard, the diplomatic twists and turns this time

around could be counter-productive, if not thought through a wider lens. With

so much pain and agony around, looking inward should be last on the minds. TIMES

CALL FOR PEOPLE TO COME TOGETHER AND MOVE FORWARD AS ONE.

All eyes on vaccine development: millions of doses to be available by end 2020 with ~1 billion run-rate possible only in 2021

Sources: Broker Research; BLA: Biologics License Application

GLOBAL EQUITIES: RESURGENCE OF THE BULLS; TACTICALLY OW ON EMs

Looking

at the equity market performance one would assume happy days are here again. The disconnect between moribund economic reality and chirpy

equity has never been stark. The macro & micro metrics have undergone

irreparable damage and coming back to pre-crisis levels is going to be a

grueling journey. Is the market pricing in a quick V-shaped recovery instead of

slow U or jagged W shaped one? Or has it played into the ‘classical

conditioning’ tactic of the US Fed? There appears to be too much of quicksand

underneath recent swift moves. Like market definition itself has changed

with just 6 FAAANM stocks contributing significantly to the sharp US S&P

500 rally from the March bottoms. After all, asset prices should reflect

economic and profit growth, the deviation is evidence of a more systemic

problem. Markets and economy might eventually converge as liquidity crisis

transitions into a solvency crisis. Till then, swimming against the tide

can be detrimental.

Balancing lives and economy: Top DMs have slightly better recovery rates with mobility rates almost similar with Top EMs

Source: Visual Capitalist; Mobility rate = workplace mobility – residential mobility, Recovery rate = total recovered / total covid-19 cases

Near-zero interest rates have the potential to drive up EM asset prices to fair levels as seen in debt space in May. If volatility drops even further and activity trends do rebound strongly as expected, EM Equities can also see good recovery as valuations are on their side. Hence, we remain Overweight on EMs against the Strategic Allocation to EM.

GLOBAL

FIXED INCOME: PUSHING ON A STRING

With

the ballooning debt on all balance sheets to tackle the Covid-19 crisis, the

total debt-to-GDP ratio has gone off the charts – at 322% and rising. Global

debt is now 40% higher than at the start of the 2008 GFC. US Fiscal Deficit

is now headed towards 20% - higher than during WW-1 and only 10% lower than

WW-2 deficit. We believe, monetary policy so far has managed to safeguard

‘wealth effect’, but it has been much less effective in stimulating economic

growth and inflation despite zero-hugging rates. The US Fed Chair did

signal a hesitance to using negative rates, particularly given some of the

downside effects on the banking sector. And that is why the EU is now headed

towards a fiscal union, and rightly so, with plans to allow European Commission

to borrow EUR 750bn (5.4% of EU GDP) for an EU wide recovery. The fear is

debt trauma can lead to lack of borrowers in the post-crisis world – even at

≤0%.

Global recession deeper than GFC is confirmed by wider spectrum of experts

Sources: IMF, EIU, Fitch Ratings, S&P Global, Goldman Sachs

GLOBAL COMMODITIES: SOME NORMALCY RETURNS; STAY OW ON GOLD

Oil made a solid comeback from the record lows of April as containment measures eased across the globe and some demand recovery was seen. But with air transportation still under a lot of restrictions and WFH becoming the norm, a full recovery to pre-crisis prices soon seems unlikely. The tapering-off of volatility is not sentimentally conducive for Gold but near-zero rates augur well for elevated investment demand. Despite Oil galloping, Gold-to-Oil ratio is high, but we still prefer being tactically OW on Gold given turbulent times.

ETF Gold holdings trending higher on Investment demand

Source: Bloomberg

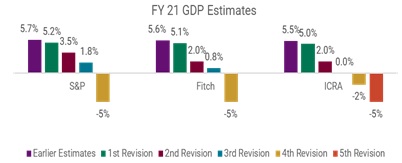

INDIA MACRO: A CRISIS LOST IN TRANSLATION

The economy was in utmost need of a shock and awe approach to resuscitate from pandemic decimation, but the layered INR 20 lakh crore ‘Atmanirbhar’ (self-reliant) economic package lacked substance and any immediate boost. Firstly, it included the already announced RBI and Govts. own relief measures totaling INR 10 lakh crores. Secondly, the Govt. adopted a response framework focused only on one side of the problem, which is supply-side, through reallocations of budgetary spending, liquidity, and credit guarantees, with complete lack of attention on how to recover demand. Thus, the fiscal impact (direct cash from Govt. balance sheet) was less than a measly 1% of GDP. Thirdly, it seems the Govt. got sucked into the fallacy of a rating downgrade. We believe, being stingy in crisis times can harm than help. In other words, fiscal conservatism can turn out to be more harmful for ratings at a time when the real need is for fiscal activism. Post this, FY21 GDP growth was equivocally lowered to negative 5% by many analysts. Moody’s too downgraded India to lowest Investment Grade rating in-line with S&P & Fitch.

Minus 5: RBI was 1st Govt. agency to acknowledge –ve GDP growth for FY21; India has seen 3 recessions in last 69 years

Sources: S&P, ICRA, Fitch Ratings

Before the Corona Crisis hit, there were tell-tale signs that the Indian economy had lost steam and was facing severe growth constraints. 4QFY20 real GDP growth collapsed to 44Q low at 3.1% with FY20 Nominal GDP at 7.2% – lowest since FY72. As green zones were opened, May-20 PMIs did bounce back a bit from record April lows but are way below cut-off mark of 50.

GDP break-up by expenditure: Consumption has also trended lower even as Investments (Capital Formation) and Exports floundered

Source: MOSPI

We

believe, every crisis opens a window of opportunity and the current global

disenchantment against China can be capitalised upon by India. Now, as

always, we are hoping against hope that some sense prevails and strong measures

reminiscent of 1991 are laid out in next few weeks – not months.

Markets can remain irrational a lot longer than you and I can remain Solvent – John Maynard Keynes

INDIA EQUITIES: PLAYING CATCH-UP; STAY OW EQUITY AND LARGE CAPS

Though, markets ended May on a flat note there was loads of activity in the middle. As if in self-doubt, the stock market rallied in latter half to catch up with its global peers. It was a game of musical chairs as all sectors took their turns one after the other to be the market leader. The FIIs got pulled back as sweet deals were lined up all through May. It started with GSK-HUL stake sale which saw net FII inflows of INR 19,000 crores on a single day. This was followed up with RIL’s steady stream of minority stake sales in Jio Platforms now valued at 50% of RIL consol. value and the largest ever rights issue in India’s history. Kotak Bank QIP and Bharti Airtel promoter stake sale were the icing on the cake. This continues to prove our thesis of quality focus.

Several sweet deals led to FII net inflows in May of INR 14,000 crore

Source: Bloomberg

Net-net, we remain tactically OW on Equities vs. Bonds for now but should Nifty 50 approach its major resistance levels of 10,300, we would turn Neutral. Within Equities, we continue our focus on Large Caps, which have fared better than Mid Caps, by attracting higher liquidity flows as well as a better 4QFY20 Earnings season so far.

INDIA

FIXED INCOME: DIMINISHING MARGINAL UTILITY; PREFER CORPS/ST

RBI is the only Govt. institution which truly believes that the policy space to address growth concerns needs to be used now rather than later to support the economy. It is also the only one to acknowledge negative FY21 GDP growth expectation amidst higher than earlier anticipated damage. MPC met once again out-of-schedule on May 22, where they announced 40bps repo rate cut on rising growth concerns. RBI’s focus has clearly shifted from rate transmission to credit growth now as it has been trying to disincentivise surplus liquidity parking by banks with itself. It also extended existing loan moratorium facility by 3 months and announced other relief measures. The RBI also stated that though the inflation outlook is uncertain, they expect it to be benign with headline CPI below 4% in 2HFY21. We believe, this leaves 50-60bps of space for cuts in a calibrated manner in rest of the easing cycle.

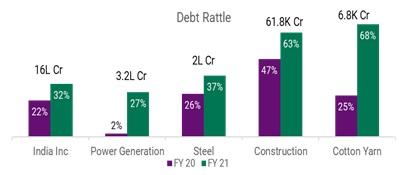

Proportion of debt with Interest coverage <1 is expected to increase sharply from 22% to 32% for FY21; could be worse for smaller companies

Sources: CRISIL Research, 800 listed companies from non-BFSI, non-Oil sectors

With Central Govt. raising its FY21 borrowings by 50% and States being permitted to increase theirs by 2% of GSDP, supply concerns have now become a reality. Short-end rates have been quickly reacting to RBI’s cuts, while on the long-end concerns of rising fiscal deficit and credit risk aversion have played spoilsport. We prefer, for 1-3M horizon: Overnight & Liquid Funds; 3M–3Yrs: high quality UST/Low Duration/Short Duration Funds; >3Yrs: high quality Banking & PSU/Roll Down Funds/Bharat Bond ETFs.

CURRENCY: SO FAR SO GOOD; STAY NEUTRAL ON USD-INR

USD-INR remained within a narrow range as market participants cautiously weighed the rising fiscal risks against the FII flows. FDI too continued with its good track record as it ended FY20 on a high (+18% YoY). FX reserves crossed USD 480bn leading to an import cover of 27-months. Negative sovereign rating actions have emerged as a downside risk which could be offset by weakening dollar index. We stay Neutral on USD vs INR.

INR has held on relatively well vs USD so far despite pandemic crisis

Source: Bloomberg

TACTICAL ASSET ALLOCATION (TAA) VIEWS & PERFORMANCE

Source: Bloomberg. Assuming a 6% annualized yield for cash.

GLOBAL ASSET PERFORMANCE SNAPSHOT

Source: Bloomberg Equity/Fixed Income Returns/Yields in local currencies. Commodities in USD. Numbers for Fixed Income are Yields. As of 31-May-20.

ROUTES TO MARKETS: MODEL ALLOCATIONS

Glossary:

WHO: World Health Organisation; HCQ: Hydroxychloroquine, US Fed: United States Federal Reserve Bank; OW: Overweight; FAAANM: Facebook, Alphabet, Amazon, Apple, Netflix, Microsoft; EM: Emerging Market; DM: Developed Market; Covid-19: Coronavirus Disease 2019; GDP: Gross Domestic Product; GFC: Global Financial Crisis; WW: World War; EU: European Union; WFH: Work From Home; US: United States; ETF: Exchange Traded Fund; RBI: Reserve Bank of India; FY: Fiscal Year; PMI: Purchasing Managers Index; GSK: GlaxoSmithKline; HUL: Hindustan Unilever; RIL: Reliance Industries Ltd; QIP: Qualified Institutional Placement; MPC: Monetary Policy Committee, CPI: Consumer Price Index; bps: basis points (100 bps = 1%); GSDP: Gross State Domestic Product; PSU: Public Sector Undertaking; USD: United States Dollar; INR: Indian Rupee; FII: Foreign Institutional Investors; FDI: Foreign Direct Investment; YoY: Year on Year; MoM: Month on Month; FX: Foreign Exchange; IG: Investment Grade