It seems the forecasters of a V-shaped recovery have been proven right if one looks at the sustenance of several high-frequency macro-indicators.

GLOBAL MACRO: RESILIENCE SEEN IN ECONOMIC ACTIVITY AS VIRUS EBBS

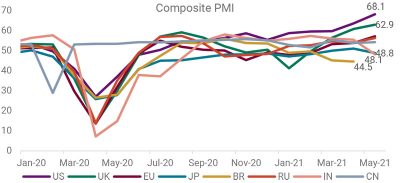

It seems the forecasters of a V-shaped recovery have been proven right if one looks at the sustenance of several high-frequency macro-indicators. PMI data across the top economies have exhibited solid resilience so far with a few exceptions like Japan, India, and Brazil. There are equally strong signs of capex demand in key economies like US and Germany as observed from new orders for capital goods and manufacturing sector, respectively. But the reason for moderation in the pace of expansion of the 3 countries is same i.e., inadequate vaccinations – all had to revert to mobility restrictions to bend the infection curve as less than 10% of the population was full vaccinated. On the other hand, countries who have jabbed at least 40% of their citizens once appear to be doing better. Even as the total active caseload has ebbed at a global level there are local episodes of newer strains emerging and waves erupting in Asia and Latin America. Hope the world will react quickly to evolving threats in future.

Vaccinations have helped support economic recovery and confidence

Source: Bloomberg; Level of 50 demarcates expansion from contraction

GLOBAL EQUITIES: INFLATION – TRANSIENT OR PERSISTENT?

1QCY21 quarterly results season has been astounding especially when one realizes that S&P 500 companies have reported earnings growth of ~50% YoY relative to consensus estimates for 20%. But the S&P 500 Index ended flat in May. Inflation seems to be an overarching concern leading to the market participants not rewarding superlative performance with equal enthusiasm. Growth has been hitting the right notes so far but what if inflation which is claimed as transient turns out to be persistent. Supply chain bottlenecks, production disruptions and rising RM prices have already increased producer prices sharply. Labour shortages due to generous unemployment benefits are also likely to lead to rise in wages which is already visible in US wage expectations. This could be less of an issue in Europe due to unionization and long-term wage contracts. Companies that lack pricing power would suffer from profit contraction if demand does not materialize as envisaged. The other risks to Equities at this stage are the elevated leveraged bets (margin finance) in the system and earlier than expected liquidity curtailment from central banks.

We retain our tactical OW stance on EU/Japan (Cyclical and Value) and stay Neutral US and Asia ex-Japan. The sectors to be OW as part of global portfolio are Materials, Financials, and Consumer Discretionary. Within IT, Comm. Services, investors should favour the mega cap, cash rich, household names.

Underperforming segments of market in CY20 are doing better now

Source: Bloomberg; CY21 is 2021 YTD performance till 03-Jun-21

GLOBAL FIXED INCOME: TRICKY POLICY PIVOTS AHEAD; OW HIGH YIELD

The central banks and markets are at crossroads when it comes to shaping up policy to effectively deal with the dynamic and structural changes underway in a post-Covid world. The PBOC has already dialed down credit impulse, BOE has stated that “continuing purchases” of assets under QE could slow somewhat as growth is surprising and ECB warned of “remarkable exuberance” in markets hinting at likely tapering before the US Fed which seemed unthinkable just a couple of months back. The Fed has rather dismissed inflation concerns and has reiterated that it is “not thinking about thinking” about tightening, though the policy minutes (ex-Chair Powell) indicated that some officials could consider talks on this issue at upcoming meetings. Given Biden’s fiscal stimulus, huge liquidity slosh and pent-up consumer demand, the Fed will soon have to choose between withdrawing support early but humbly or later but more aggressively. This involves the dual risks of market instability and loss of credibility and calls for extreme caution. Retain OW on HY relative to IG and Sovereign bonds.

Moderation seen in central bank balance sheet expansion

Source: Bloomberg

GLOBAL COMMODITIES: MANAGEABLE VOLATILITY FUELS BUOYANCY

Prices of certain commodities such as steel and corn have retreated from the highs hit within May-21, but oil has remained resilient, driven by speedy signs of increasing travel around the world and new pressures on supply in some regions. However, most of the remaining commodity complex had a strong May-2021 Overall, the 5Cs: copper, crude oil, corn, coffee and crypto remained in focus. Gold ETF holdings could have possibly bottomed out and the accompanying resilient net contracts positions make us retain our OW on Gold.

Gold back on investors radar led by geo-politics and crypto volatility

Source: Bloomberg

INDIA MACRO: EFFECTIVE VACCINATION STRATEGY HOLDS KEY

Caught off guard by the second wave of Covid-19, and cases doubling between March and May, the Indian healthcare infrastructure came under immense pressure to test, treat and vaccinate the population. After the disruption from the first wave, the economy showed signs of healing as 4QFY21 GDP grew by 1.6% over 4QFY20. The real GDP growth for FY21 came in at -7.3%, its largest ever contraction, albeit better than -8% contraction projected. There was a significant pick-up in investment and government consumption in the 4Q, witnessing expansion of 14% and 28% YoY. Gross Fixed Capital Formation (GFCF), which measures investments as a % of GDP was at a 26-quarter high of 31.2%. Economic growth in FY22, however, has seen downward revisions in forecasts, with the 1QFY22 likely to now grow by 18.5% vs >25% estimated earlier. Regional lockdowns seem to have played their role in breaking the transmission chain, but mass inoculations only will aid quick return to trend growth trajectory. Stay vigilant to minimize the impact of forthcoming waves.

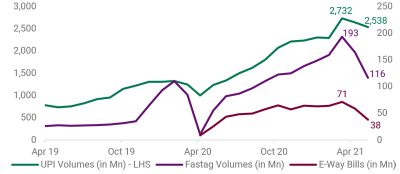

Manufacturing PMI fell to 50.8 in May-21 compared to 55.5 in April-21, hitting the lowest level in 10 months. Services PMI too slipped below 50 as India’s unemployment rate jumped to a 12-month high of 11.9%. Auto volumes for May witnessed a high double-digit fall, with commercial vehicles seeing the sharpest decline, with Fast-Tag and E-Way Bill data for the month falling sequentially lower as well. With mobility and lock-down like restrictions expected to ease gradually as a higher percentage of the population getting vaccinated, we could see a turnaround in economic activity like the advanced economies.

Govt. capex spending growth of 28% YoY in 4QFY21 led to Investment rate of >30% after 6 long years

Source: Bloomberg

Regional lockdowns managed to break the infection chain but impacted macro recovery all over again though less than last year

Source: NPCI, GSTN

INDIA EQUITIES: MAKING NEW HIGHS; TURN OW EQUITY / RETAIN OW MID

The global optimism seems to have rubbed off on Indian Equity markets offsetting the ravaging reality of 2nd wave of COVID on lives and livelihoods. The benchmark Nifty underwent a prolonged consolidation post the sharp rally driven by a pro-growth Budget. The time correction bottomed out as peak cases started trending lower even when the 2nd wave impact was much broader and deeper than last year. Once the indices climbed the health-related wall of worry, they broke all resistances and sprinted to all-time highs. The earnings season has turned out to be better than expected with ~70% of the Nifty 500 companies that have announced results so far reporting surprise or in-line vs estimates. Financials and Consumer Staples reported least surprises whereas Energy and Industrials the most. Management commentary was a mix of confidence, hope and caution depending on the current sectoral impact and outlook. Though, FIIs turned net buyers in May, there conviction levels appeared subdued, but it was again not true when it came to PE investing. Volatility also fell off sharply towards the end of the month as indicated by VIX levels of below 17.

We again turn Overweight on Equity vs Bonds primarily driven by cooling of near-term risk concerns, reasonable forward valuations, and healthy earnings growth. We Retain our OW view on Mid vs. Large caps led by relatively better valuations and higher forward EPS upgrades. As stated earlier, one could consider satellite positions in short-term thematic opportunities like PLI, Infra, Value, EV, IT Services, Pharma, BFSI with a 6-12-month view.

~70% of companies reported in-line or surprise on earnings front

Source: Bloomberg; Note: 367/500 companies reported 4QFY21 results so far

INDIA FIXED INCOME: CAN RBI BE A SAVIOUR FOR ALL?OW CORP / SHORT TERM

Every 2 months, all market participants wait with bated breath to listen to Governor Bond (Mr. Das). Through the pandemic, RBI has been the torch bearer when it comes to formulating policy to ensure financial stability and economic health. And it continued when the MPC announced its policy on 04-Jun-21 as well. Beyond the expected status-quo on rates and stance, FY22 real GDP growth has been downgraded from 10.5% to 9.5% and CPI forecast has been raised only slightly from 5% to 5.1% with risks evenly balanced. G-SAP 2.0 was announced with an outlay of INR 1.2tn for 2QFY22 (in-line) with SDLs likely to be a part of it as INR 100bn of the last tranche of INR 400bn of GSAP 1.0 has been allocated towards it. The forward guidance will keep G-Sec yields in check. Special TLTRO window of INR 150bn has been opened for contact intensive sectors like hospitality, travel and tourism, aviation. Additional liquidity facility has also been extended to SIDBI for on-lending to MSMEs along side enhancing aggregate exposure from INR 250mn to 500mn for restructuring under resolution framework 2.0. What is good for borrowers is bad for savers as they must bear the brunt of negative real rates. The Govt. now needs to do its bit on fiscal and health policy front to revive and sustain growth. We like top-quality corporate issuances/funds and short-duration investments for debt allocations while avoiding G-Secs and the long end of the curve.

Systemic Credit growth has been subdued pulled down by Industry

Source: Bloomberg

FX: USD COULD STRENGTHEN VIA PBOC BUT INCREMENTAL CARRY WANING

China forced its banks to hold more foreign currencies in reserve for the first time in more than a decade, its most substantial move yet to rein the surging yuan. The move effectively reduces the supply of dollars and other currencies onshore, putting pressure on the yuan to weaken. However, the sovereign yield differential of the US over its DM peers has shown some signs of weakness recently indicating the potential carry return from the USD might be fizzling out. INR could continue its strength as re-opening pans out further supported by $600bn in FX reserves. We turn Neutral on USDINR given the current dynamics.

Sovereign yield differential of US over DM showing some weakness

Source: Bloomberg. Note: DM constitutes AUS, Canada, EUR, Japan, Sweden, Switzerland and UK

TACTICAL ASSET ALLOCATION (TAA) VIEWS & PERFORMANCE

Source: Bloomberg. Assuming a 6% annualized yield for cash.

GLOBAL ASSET PERFORMANCE SNAPSHOT

Source: Bloomberg Equity/Fixed Income Returns/Yields in local currencies. Commodities in USD. Numbers for Fixed Income are Yields. As of 31 st May 2021.

ROUTES TO MARKETS: MODEL ALLOCATIONS