The World entered the pandemic at the peak of the US-China trade war and exited right into the Russia-Ukraine territorial war. What began as a “special military operation” by Putin to “denazify” Ukraine soon turned into a War with unprovoked attacks on civilian facilities, including nuclear power plants. Global powers, except for China, have either condemned Russia’s violent actions or have imposed severe economic sanctions – the most effective and modern war tool.

GLOBAL MACRO: A WAR AGAINST WESTERN HEGEMONY AND NATO

The World entered the pandemic at the peak of the US-China trade war and exited right into the Russia-Ukraine territorial war. What began as a “special military operation” by Putin to “denazify” Ukraine soon turned into a War with unprovoked attacks on civilian facilities, including nuclear power plants. Global powers, except for China, have either condemned Russia’s violent actions or have imposed severe economic sanctions – the most effective and modern war tool. The intended debilitating impact was soon seen – USD-Ruble crashed 50% to record low, local equity index MOEX collapsed 50% before trading was suspended, and rating agencies downgraded Russia’s sovereign debt to junk. But the crippling of trade and supply chains and a ban on SWIFT interbank payments could turn out to be the final nail in the coffin for globalisation as we know it. Russia and Ukraine’s GDP will be the most impacted, but sharp spikes in food and energy prices would moderate GDP forecasts for other economies too, primarily Europe, due to its high dependency on Russia for Oil and Gas. Consequently, this would bring greater focus on the transition to clean energy.

Russia stands to lose the most from its invasion of Ukraine 2022 GDP YoY% Forecast Trend

Source: Bloomberg

GLOBAL EQUITIES: SWINGING WILDLY

Equities have had one of the worst starts in 2022, unlike any other seen in the past, as fear gripped investors’ minds led by elevated uncertainty around the Russia-Ukraine War. Risk-aversion came to the fore, evident from the surging VIX and Citi risk indices. After all, since WW-2, no nation from the European continent had been at War, until today. Also, the consequences of warfare are difficult to fathom given the vast economic interlinkages, especially when it involves one of the largest suppliers of commodities. The regional conflict will end soon, and the World will move on, though some repercussions might last longer. Investors should focus on fundamentals and asset allocation and take advantage of the price corrections, rather than get bogged down. US quarterly earnings reported a growth of 30% YoY vs expectations of 20%. The UK indices outperformed due to the higher weightage of energy and mining. We retain our tactical OW stance on the US and Japan and UW on Asia ex-Japan and EMs. Reduce Europe from Neutral to Underweight on risks to economic outlook.

Global Equities in correction mode post 2 years of superlative show

Source: Bloomberg

GLOBAL FIXED INCOME: BETWEEN A ROCK AND A HARD PLACE; OW HY

Central bankers’ plates were more than full before the Ukraine crisis erupted. The War has materially changed the growth-inflation dynamics making their task even more difficult. A flight to safety and risk-off sentiments have pulled down bond yields which had risen steeply post the hawkish pivot from Powell. In a couple of weeks, consensus has changed from 50bps rate hike at the mid- March meeting of the US Fed to a less than 100% possibility for even a 25bps hike. With inflation at a record high and unemployment at pre-pandemic levels in US and at a record low in Europe, monetary tightening is necessary. Still, financial stability and growth concerns could weigh heavy while reaching a decision. Russia’s central bank hiked the policy rate to 20%, but that could not prevent Ruble from getting hammered. Retain OW on HY relative to IG and Sovereign bonds, but as HY spreads have narrowed sharply, investors could look at low beta long-short equity funds and zero beta market neutral products.

Surging global inflation is the foremost worry for policymakers

Source: Bloomberg

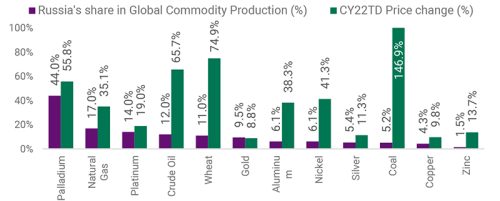

GLOBAL COMMODITIES: NEW POLITICAL WEAPONS; TURNING OW ON GOLD

The last week saw one of the biggest rallies in commodities as Russia’s invasion of Ukraine roiled markets. With Russia being a key exporter of vital commodities contributing 12% of global crude supply, 39% of EU’s gas imports, 18% of global wheat exports, 3rd largest exporter of coal etc., traders scrambled to find alternative supply sources considering hefty sanctions. The price surge across energy, industrial and precious metals, and agricultural produce adds to the already-elevated inflationary pressures, hurting consumers. After falling over 2021, gold prices moved higher, driven by: (a) concerns about possible supply disruptions as Russia is a significant producer of gold, (b) safe- haven demand and (c) a pick-up in inflation expectations and (d) volatility and uncertainty. Our tactical allocation turns to OW from Neutral Gold with technical indicators showing breakout from the consolidation price range.

Commodity markets are in turmoil with prices hurtling higher across the board – food, energy, industrial and precious metals

Source: Moody’s Analytics Report; Bloomberg

INDIA MACRO: NEAR-TERM HEADWINDS TO GROWTH FROM THE WAR

India witnessed a 5.4% YoY growth in GDP in Q3FY22, with the pace of growth slowing down primarily due to the third wave of Covid-19 infections, which forced the imposition of local restrictions. As this was lower than expectation of 6-6.5%, FY22 GDP growth estimates have also been downgraded marginally from 9.2% to 8.9%. Exports growth of 21% provided a significant push for the quarter, supported by healthy global demand and rising commodity prices. Contributing nearly 20% of the GDP for the quarter, the upswing in exports is likely to achieve the USD400bn target for FY22. However, increasing concerns stemming from the ongoing conflict between Russia and Ukraine has been the sky-rocketing Crude Oil prices which would widen CAD. As per Nomura, every 10% rise in crude oil price could shave off around 0.2% from GDP growth in India and add around 0.4% to inflation. With FD for Apr-Jan FY22 at 59% of BE, it is to be seen if Govt. cuts excise duty to safeguard the consumers from retail fuel price hikes expected post State elections outcome. India’s largest and long-awaited IPO of LIC is in doubt given the market conditions. The draft papers are filed with SEBI, and further amendments in rules to permit up to 20% FDI through the automatic route for the country’s primary insurance corporation.

India’s Composite PMI for Feb-22 came in at 53.5, marginally higher than Jan- 22 but lower than its long-term average. Manufacturing companies witnessed a more robust increase in business activity relative to service providers, with input cost inflation increasing slower for both versus last month. GST collections were 18% higher YoY, sustaining near INR 1.3tn for five months. Auto OEMs reported another month of mixed numbers, with volumes in 2Ws and Tractors disappointing, while PV and CV demand momentum sustained with easing supply chains and new launches. Skymet’s preliminary forecasts for 2022 indicate “normal” monsoons this year, which is critical for revival in the subdued rural economy.

Q3FY22 GDP growth came in lower than expected

Source: Bloomberg

Business confidence has weakened a bit as optimism dropped

Source: Bloomberg

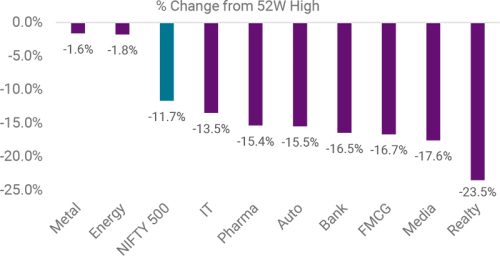

INDIA EQUITIES: PUSH-AND-PULL PHASE; STAY OW ON EQUITY AND LARGE

MSCI India’s premium to MSCI EM, which had risen to stratospheric levels, is now mean reverting but faster than expectations. Relentless FII selling has been offset to a reasonable extent by DII buying, mostly Insurance companies in Feb-22. But global risk aversion has inflicted much pain on broader markets, with many stocks down 30-50% from their recent peaks. 3QFY22 results (for Nifty 500) were in-line with expectations at the sales level but missed operating margins. However, forward EPS estimates could be at risk of downgrades if actual growth-inflation numbers fall short of quarterly forecasts. When markets are priced to perfection, any disappointment on the earnings front drives a harsh reaction by participants. Current volatility could stay for some time and offer good accumulation opportunities given India’s positive medium- term outlook and relatively superior macro fundamentals. Valuations are below 1/3/5 Year averages for both trailing and forward basis for benchmark indices. Given the fall in recent times, it is not humanly possible to call the peaks and troughs in market. Hence, investors could spread their allocations in two to three tranches in lieu of SIPs or STPs to achieve their target allocations in Equities in the ongoing market correction. We retain our tactical OW stance on Equity vs Bonds and Large-caps vs Mid-caps.

Bruised and battered: Several sectoral indices have underperformed the benchmark Nifty 500 index, yielding bottom-up opportunities

Source: Bloomberg

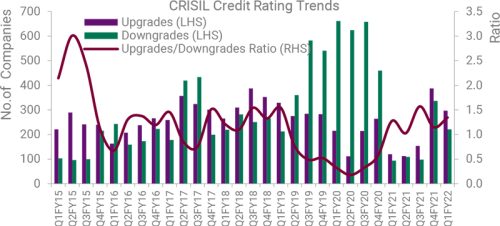

INDIA FIXED INCOME: LAST DOVE STANDING; OW CORP AND SHORT TERM

At its Feb-22 meeting, the RBI’s MPC surprised everybody by maintaining the status quo on policy rates and stance compared to the consensus expectation of a reverse repo hike. RBI cited a fragile recovery and easy inflation as reasons behind its action. The minutes further revealed that the MPC expects inflation to moderate over the next fiscal to 4.5% and growth to slow. Hence, it sees room for policy to remain accommodative to support the revival. The deputy governor also dismissed concerns that “RBI is behind the curve” relative to global peers stating that the fast pace of policy normalisation may “kill recovery”. The yields that had jumped sharply post Budget cooled off post the extremely dovish meeting. The RBI also cancelled a few scheduled G-Sec auctions as cut-off yields were inching higher post Budget on higher gross borrowing and fiscal deficit for FY22-23. Unending Govt. bond supply was constantly weighing heavy on G-Secs and has been our primary thesis for preferring good-quality Corporate Bonds / Funds adopting a barbell investment strategy to address volatility and duration risk. Going into FY23, high inflation, liquidity tapering, and fiscal deficit concerns would keep pressure on bonds, especially G-Secs.

Credit ratio and loan growth are showing signs of improvement

Source: Bloomberg

CURRENCY: USD CARRY TRADE CONTINUES TO REMAIN ATTRACTIVE

While world-over inflation is raising its ugly head, India at least stands to benefit from sequential absolute m-o-m declines in its CPI levels. This offers attractive yield farming for carry traders in the greenback, where the US continues to see peaking inflation. On the geopolitical front, while Russia has imposed currency transaction curbs on the Ruble, it would be interesting to see how the nation manages its currency risk from within and via external means. Interestingly, India (and Japan) has renewed bilateral swap arrangement (BSA) of size USD 75bn for USD effective 28-Feb-22. Technical momentum indicators also point to a favourable near-term outlook for the USD vs INR.

The absolute level of inflation softening for India vs US, but War could change that now

Source: Bloomberg. Note: Seasonally Adjusted for US

TACTICAL ASSET ALLOCATION (TAA) VIEWS & PERFORMANCE

Source: Bloomberg. Assuming a 6% annualized yield for cash.

GLOBAL ASSET PERFORMANCE SNAPSHOT

Source: Bloomberg Equity/Fixed Income Returns/Yields in local currencies. Commodities in USD. Numbers for Fixed Income are Yields. As of February 28, 2022.

ROUTES TO MARKETS: MODEL ALLOCATIONS