When the world was in the grips of the pandemic last year, policymakers doled out massive stimulus to support the flailing economy, especially in the DMs.

GLOBAL MACRO: THE RETURN OF BIG GOVERNMENT

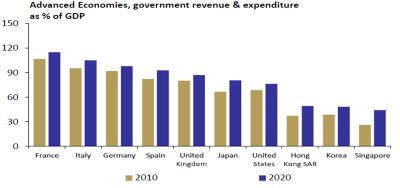

When the world was in the grips of the pandemic last year, policymakers doled out massive stimulus to support the flailing economy, especially in the DMs. That action supplemented by vaccination success has yielded beneficial results primarily in the US followed by UK and Europe, as deciphered from high- frequency indicators like retail sales, consumer confidence, and PMI. But this also had a logical corollary of rising government ’size’ as a % of GDP across regions. And along came record high borrowings and fiscal deficits. On top of the Rescue Plan, Biden has now formally launched Jobs (infra) and Families (human capital) Plan with a spending outlay of USD 2-4tn over the next decade. No surprises that partial funding will eventually come from raising taxes of all kinds, i.e., capital gains, personal and corporate income tax rates. But this should work towards global good as US growth tends to have a solid positive rub-off on EU and Asia economies due to trade interconnectedness, with the former constituting 20% and latter 30% of US goods imports.

Government ’size’ has been increasing across the board

Source: IMF, LGT

GLOBAL EQUITIES: ON THE MOVE; OW EU/JAPAN

Few large EMs like Brazil, India, unfortunately, were caught unawares by the COVID 2nd wave – a tsunami actually – as innumerable lives and jobs have been lost, which could have been saved by optimal planning. Differential methods have led to a K-shaped recovery between economies with DM GDP and equity markets doing relatively better. They seem to have imbibed learnings from past waves and handled lockdowns and inoculations well, but EMs failed. Chinese equities have also fared poorer, driven by a reversal in easy liquidity stance though the economy is on a strong footing and the pandemic is under control. All that fiscal largesse (direct cash transfers) and restrictions limiting spending have led to excess household savings globally – USD 5.4tn to be precise (6% of world output) at the end of Mar-21. As countries approach herd immunity and businesses reopen, these consumers would unleash the savings stockpile leading to a sharp rebound in spending. The Conference Board Global Consumer Confidence Index has hit its highest level since records began. 87% of US blue chips that have reported 1QCY21 results have surprised positively.

We maintain our tactical OW stance on EU/Japan (Cyclical and Value) and stay Neutral US and Asia ex-Japan. The sectors to be OW as part of global portfolio are IT, Comm. Services, Materials, Financials, and Consumer Discretionary.

Households have saved a lot more since start of pandemic

Source: FT, Moody’s

GLOBAL FIXED INCOME: YOU HAVE MY WORD (OR NOT); OW HIGH YIELD

The current setup indicates that short-to-medium term macro-economic data will be good as US payroll numbers have shown improvement. Even CPI rose more than expected. At its April meeting, Fed stated that it will still be “some time” before it sees “substantial further progress” towards its goal of maximum employment. But few participants think growth and inflation are heating up, and the Fed could take some steps towards tapering QE as early as June or August. Markets are thus envisaging a rate hike ahead of the central bank’s forecast. The ECB also maintained its easy stance but acknowledged that the US and EU are differently placed when it comes to growth and inflation outlook, and hence its actions will not necessarily align with the US Fed. On the contrary, BoJ has downgraded/upgraded FY22 CPI/growth forecast to 0.1% and 4% as the impact from a resurgent virus is likely to be offset by strong exports. We retain our tactical OW on HY bonds relative to IG and Sovereign bonds.

Global inflation to head higher, before settling down again

Source: JP Morgan, LGT, *Core inflation is headline CPI, excluding more volatile components like food and energy

GLOBAL COMMODITIES: RUNAWAY RALLY; REMAIN OW GOLD

Brent has appreciated ~6% in Apr-21. So has most metals and agri-related commodities as well. In India, domestic natural gas production apart from ONGC and Oil India could triple in the next three years from 11mmscmd in FY21 to 34mmscmd in FY24e (per MoPNG), with demand spanning across all sectors in the economy. Steel prices have also rallied as China’s consumption spree continues unabated to the point that it is now willing even to import. Multiple COVID waves prolong the risk environment, which augurs well for Gold because of which we remain OW on the yellow metal.

Both Agri and Industrial Metals prices have been on a tear

Source: Bloomberg, both indices have been rebased to 100 as of 1-Jan-2019

INDIA MACRO: ECONOMIC RECOVERY DELAYED, NOT DERAILED, BY 2ND WAVE

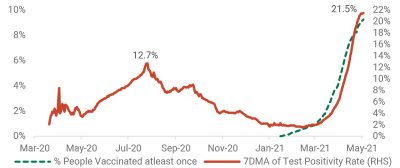

Despite being the world’s largest vaccine manufacturer and ceasing vaccine exports in Mar-21, India is witnessing the ravaging effects of the 2nd wave of COVID, with more than 4 lakh daily cases and a positivity rate touching 25%. The surging infections and deaths due to lack of reliable healthcare infrastructure compelled the Govt. to turn towards foreign aid in the form of oxygen, medical equipment, and medicines. And this occurs just after the ‘’Vocal for Local’’ slogan from last year says a few things about the gross mismanagement and complacency. With Phase-3 of the adult (18-45 age group) vaccination program getting derailed due to supply shortages all over the country, the need for scaling up vaccine manufacturing capacities and efficient procurement is emphasized to achieve mass immunity of the country’s vast population by 2022. Towards this end, the Govt. did extend credit of INR 45bn to Serum Institute and Bharat Biotech, but it is a case of too little too late. Efficient and rapid utilisation of INR 500bn allocated to the vaccination program in the recent Union Budget is the need of the hour. Only if the Govt. would have kept political campaigning aside and focused on the immediate task at hand – that of saving precious lives. Even industry lobbies such as CII and FICCI are now asking for a national lockdown.

Consumption indicators like auto volumes, electricity, fuel consumption and housing registrations plummeted in Apr-21 as night/weekend curfews and localised lockdowns were enforced all over the country to break the vicious chain. Manufacturing PMI came in at 55.5 for Apr-21, marginally higher MoM but Services PMI fell to 3-month low to 54, whereas GST collections recorded another all-time high of INR 1.4tn. Forecasts from IMD and Skymet indicate a Normal monsoon for the third year in a row, raising the odds again of a good Kharif harvest, thereby supporting Agriculture GDP and rural consumption.

As vaccinations (<2%) failed to reach critical mass before 2nd wave hit, test positivity rate has shot up to ~25%

Source: Our World In Data

Though restrictions are not as stringent as last year’s national lockdown, nascent economic recovery has been impacted

Source: Our World In Data

INDIA EQUITIES: BLUE SKIES AT RISK; TURN NEUTRAL ON EQUITY / KEEPOW MID

Equity markets are always forward-looking and tend to move on from transient economic disruptions quickly. When valuations are as stretched as in current times, corporates have no space for mistakes in business performance and earnings delivery. But 100 companies of NSE500 that have reported so far have posted a 28% EPS miss at an aggregate level with 40% beating consensus estimates. Though the 2Yr forward EPS growth is still healthy, an unforeseen return of localized lockdowns and uncertainty around Govts. ability to quickly immunise mass populations has led to FY22 GDP downgrades. 1QFY22 had the benefit of base effect but now will be bearing the largest brunt of this mishap. Higher RM prices have started to impact operating margins for a few companies as demand recovery got nipped in the bud, and they could not raise prices in line. Weighed by these concerns, FIIs turned net sellers after almost a year while DIIs managed to offset these outflows. But the story was a total contrast on the private equity side as PE/VC firms created more unicorns YTD than the whole of 2020. Rational or irrational – only time will tell.

Benchmark indices have undergone time and price correction leading to better forward valuations than before but above avg. VIX levels, weakening near-term macro-dynamics, and risks from FII outflows have led us to turn Neutral on Equity vs. Bonds. Relatively better valuations and higher EPS upgrades continue to support our OW view on Mid vs. Large caps. As stated earlier, one could consider satellite positions in short-term thematic opportunities like PLI, Infra, Value, EV, IT Services, Pharma with a 6-12-month view.

2nd wave led volatility sapped out the Budget enthusiasm

Source: Bloomberg

INDIA FIXED INCOME: AHEAD OF THE CURVE; OW CORP / SHORT-TERM

RBI continues to be both innovative and proactive in its approach to address debt market volatility and safeguard financial stability. At its 7-Apr-21 MPC meeting, RBI kept policy rates on hold, maintained an accommodative stance but shifted from time- to state-based guidance to reassure markets that it continues to be pro-growth and less worried about inflation risks. To ensure orderly evolution of the yield curve, RBI announced a GSAP 1.0 program of INR 1tn to be conducted in tranches in 1QFY22, hinting that more could follow. At an unscheduled press briefing on 05-May-21, the RBI proposed an on-tap liquidity facility of INR 500bn to emergency health services, SLTRO of INR 100bn for SFBs, and reopened restructuring window for individual and MSMEs. We like top-quality corporate issuances/funds and short-duration investments for debt allocations while avoiding G-Secs and the long end of the curve.

WPI inflation at 8-year high led by industrial raw material prices

Source: Bloomberg

FX: RBI FORWARD INTERVENTION AND FED COMMENTS FAVOUR USD

The dollar index has lost its ground vs. the usual suspects of its basket. However, the INR has fallen even more against these same constituents for Apr- 21, thus weakening vs. the USD. A dichotomy exists within the EM currency basket: most EM currencies strengthened vs. the USD while the INR weakened against the greenback. The Fed has strengthened its assessment of the US economy and signaled that risks have diminished, leaving the US policy interest rate near zero and maintaining its USD 120bn monthly pace of asset purchases. This has lent some comfort to the USD. The RBI has stopped buying USD (coincidently also since US DOT included India as a currency manipulator in its Apr-21 report) but is now intervening in the forward market with the forward premium for the USD increasing to as high as Rs. 78/$.

RBI pushing the forward premium in NDF and onshore (buying USD)

Source: Bloomberg

TACTICAL ASSET ALLOCATION (TAA) VIEWS & PERFORMANCE

Source: Bloomberg. Assuming a 6% annualized yield for cash.

GLOBAL ASSET PERFORMANCE SNAPSHOT

Source: Bloomberg Equity/Fixed Income Returns/Yields in local currencies. Commodities in USD. Numbers for Fixed Income are Yields. As of 30 th April 2021.

ROUTES TO MARKETS: MODEL ALLOCATIONS