The world economy entered 2022 with durable tailwinds but had to soon weather the storm in the form of multiple headwinds arising from the Russia- Ukraine war, decade-high inflation, aggressive monetary tightening by global central bankers and China’s strict enforcement of the zero-Covid policy.

GLOBAL MACRO: A VUCA WORLD LIKE NEVER BEFORE

The world economy entered 2022 with durable tailwinds but had to soon weather the storm in the form of multiple headwinds arising from the Russia- Ukraine war, decade-high inflation, aggressive monetary tightening by global central bankers and China’s strict enforcement of the zero-Covid policy. Labour markets look robust with low unemployment rates and high wage growth but slowing retail sales and falling consumer confidence risk nipping the recovery in the bud. Global PMI data in expansion zone (except in China) and release of pent-up savings are supportive of likely improvement in momentum subject to no new complexities coming to the fore. However, China’s Covid-19 related lockdowns are spilling over to regional economies along the supply chain. High-frequency data points to factory disruptions and logistical chain congestions. Further, exports to China from Korea, Vietnam, and Japan exhibited softness in Mar-Apr-22. US’s shocking negative GDP growth for the 1QCY22 requires monetary policy custodians to do a delicate balancing act of raising rates to tame inflation without tipping the economy into a recession.

China Covid-19 lockdowns are the biggest macro threat currently

Source: NBS, LGT, Level of 50

GLOBAL EQUITIES: RISK-OFF DRIVEN BY A MYRIAD OF NEGATIVES

Risk assets fell like nine pins in Apr-22 after a smart bounce in Mar-22. There was no place to hide within Equities except UK FTSE, which closed in green and is also the only major index to yield positive returns YTD, mainly for its Energy and Materials concentration. The correction also coincided with US 10-year real rate, briefly reverting to the positive. According to BofA, the (negative) returns correlation between risk assets is strongest when the 10-year real rate rises to 0.0-0.5%. The top-down revenue outlook looks reasonable compared to the latest GDP growth forecasts when one looks at the consensus financial projections for this year and next; however, the margin outlook remains overly optimistic, especially within the high inflationary stresses. Hence, investors should be ready for downward EPS revisions, perhaps for the rest of the year. We reduce our tactical OW stance on Consumer Discretionary to Neutral but retain our tactical OW stance on Equities vs Bonds. We maintain our tactical OW stance on the US and Japan and UW on Europe, Asia ex-Japan and EM ex- Asia. One can also look at Dividend Yield and Asian REITs as defensive themes.

Profit margin projections look aggressive – downside risks to EPS

Source: Bloomberg, LGT

GLOBAL FIXED INCOME: SLAMMING THE BRAKES; TURN OW ON IG VS HY

The US Fed fully met market expectations of a 50bps rate hike at its May-22 meeting and explicitly steered clear of any possibility of a 75bps rate hike at its upcoming conferences. The capital markets breathed a sigh of relief on this specific forward guidance as this was considered relatively dovish vs earlier held beliefs. As a result, the US 2-year G-sec yield dropped precipitously by 25bps throwing the yield curve inversion theory out of the window. Similar actions were seen from other central banks, too – BoE hiked key rates to 1% (highest in 13 years) to tackle a cost-of-living crisis in the UK, and RBA also raised its benchmark interest rate for the first time in 11 years at an unscheduled meeting. The ECB could start raising rates as early as Oct-22. The BoJ is resorting to a yield curve control policy, leading to a massive yen depreciation vs USD. The lockdowns have become a threat to China’s 5.5% CY22 GDP growth target that the PBOC has cut banking reserve requirements and publicly pledged to support the economy. Given the unfavourable risk-reward, we turn Neutral on HY bonds and go OW on IG. We retain our UW on Sovereign bonds.

Equity returns correlation with US 10-year real yields are negative when real yield is between 0.0% and 0.5%

Source: Bloomberg, LGT

GLOBAL COMMODITIES: MIXED BAG; RETAIN OW GOLD

In their result call, Norsk Hydro, the fifth largest aluminum producer ex-China, indicated increasing market uncertainty due to slower China growth and the Russian invasion of Ukraine. Metals rallied during 2020 and 2021 and reached record highs in Mar-22. Copper is now down ~10% from its recent high, with aluminium down ~25% from its peak. On the other hand, natural gas prices surged as much as 9% on 03-May-22 to the highest levels since 2008 as Russia’s war on Ukraine shifted more US supplies overseas. Agri products are also in a different orbit, with edible oil prices going through the roof. With inflation making newer highs and risk-off trade coming back, we maintain OW on Gold.

Commodities were an outlier in an otherwise risk-off month

Source: Bloomberg, LGT

INDIA MACRO: GLOBAL FACTORS WEIGH HEAVY

India’s merchandise exports extended their record-breaking run into Apr-22, registering a 24% YoY growth to USD 38.2bn, driven by chemicals, electronic goods, and petroleum products. Exports of Indian wheat have also been booming due to the supply disruptions from the Russia-Ukraine conflict, improved crop quality, and a sharp price increase. However, the crop output will need to be monitored closely after the ongoing heatwave, which is likely to impact production. The hot sweltering conditions and increased economic activity have also led to a spike in electricity consumption, with power demand at all-time highs. With economic activity now flourishing, India’s Composite PMI saw an expansion from 54.2 in Mar-22 to 57.6 in Apr-22, growing at the fastest pace in five months due to a strong surge in services output. Increased industrial activity has also led to record high GST collections of INR 1.68tn in Apr-22 and healthy rail freight and port volumes. However, inflationary pressures persist with the CPI recorded at 6.95% for Mar-22 (a 17-month high) and expectations for Apr-22 at 7.5% to 8%.

Excise duty reduction by states could have helped lower pump fuel prices and inflation, but the greater fertiliser subsidy announced last month risks widening the fiscal deficit. Budgeted divestments and sustainability of current tax buoyancy would be a key monitorable. LIC’s IPO is finally underway, with INR 210bn raised through a 3.5% stake sale in India’s largest ever primary offering at a lower valuation than initially projected.

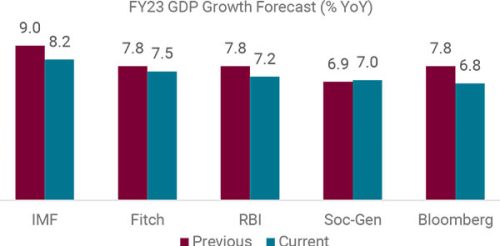

India’s FY23 growth outlook has seen recent downgrades…

Source: Bloomberg

…but monthly indicators are showing steady upmove

Source: CMIE; Data series rebased to 100 as of 31-Dec-19

INDIA EQUITIES: STAYING FOCUSED; RETAIN OW ON EQUITY; TURN NEUTRAL ON LARGE VS MID

After a strong comeback in Mar-22, Equities succumbed to uncertainties – some old and some new. Strict mobility restrictions in vital Chinese cities added

to global growth slowdown woes, while Russia’s aggression in Ukraine pushed up energy and food prices even higher. So, new demand concerns arose even

as supply chains remained in disarray. Stock prices have also reacted to incoming corporate results and management commentary. ~135 of the NSE 500 companies have reported 4QFY22 earnings so far with revenue / PAT growth of 20% / 25% on a YoY basis helped primarily by base effect as last year was impacted by Covid 2.0. But the sequential growth numbers are lower and mixed as few sectors had to bear margin pressure due to spiralling input prices and tepid recovery in demand. We believe persistent inflation is a higher risk for bonds than lower growth is for Equities. One needs to filter the noise and focus on building portfolios with quality leaders available at reasonable valuations in the current chaotic environment. We retain our Overweight stance on Equity vs Bonds but have reduced conviction compared to last month as risk sentiment, and momentum indicators have turned Neutral. We are also turning tactically Neutral between Large and Mid-caps, chiefly driven by improving breadth and daily trading activity for the latter vs former even as relative valuations still allow Large-caps to move up.

The Promoters, Retail and DIIs, have absorbed FIIs reduction in holdings over last one year

Source: Capitaline

NDIA FIXED INCOME: RBI REGAINING CREDIBILITY; OW CORP AND SHORT TERM

The RBI stunned the markets on 04-May-22 by announcing a repo rate hike of 40bps and a CRR hike of 50bps perturbed by inflationary pressures. The MPC policy announcement came out of the blue during trading hours and before US Fed’s scheduled meeting. The RBI played catch-up to global central banks and signalled its priority of fighting inflation while supporting growth. It also mentioned that the hike is in-line with its “withdrawal of accommodation” stance taken at the Apr-22 meeting and should be considered a reversal of the rate cut of 40bps done in May-20. The off-cycle action has now set the rate-hike phase in motion with consensus building in terminal repo rate at pre-Covid levels of 5.15% by Dec-22. Liquidity withdrawal has also begun with a CRR hike, which will likely pick up pace in the coming months. This action opens space for RBI to conduct OMOs if the yields shoot up to abnormally high levels and make Govt. debt management difficult. Corporate bond yields are at risk of rising as current spreads to G-secs are unsustainable, but Govt. refinancing and debt issuance are a more significant concern. We prefer good-quality Corporate Bonds / Funds adopting a barbell investment strategy to address volatility and duration risk. Going into FY23, high inflation, monetary tightening, and fiscal deficit concerns would keep pressure on bonds, especially G-Secs.

The yield curve has moved closer to 2019 levels post RBIs blinder – except for the 1-year and below maturities

Source: Bloomberg

CURRENCY: SUSTAIN OW USD TRADE

The USD has shown rapid appreciation in the last few months, which the Fed should take cognizance of, especially since this could pose a threat to global growth. While the Fed has hiked by 50bps in May-22 and has guided for consecutive 50bps hikes in the next two meetings, the current near limitless supply (Fed’s balance sheet stands at USD 9tn) of the greenback makes it an attractive safe-haven in current times of political turmoil. Moreover, slapping sanctions on USD-priced commodities highlights the economic dominance of the dollar and poses questions about the currency’s monopoly. However, the “carry trade” on the USD should likely sustain in the short run. The Rupee has behaved reasonably well, aided by RBI’s intervention in FX markets but faces depreciation risks due to rising inflation and higher CAD. Retain OW USD vs INR.

USD has ascended in stellar fashion across a broad basket – INR has depreciated the least in almost all periods

Source: Bloomberg. Note: As of 29-Apr-22

TACTICAL ASSET ALLOCATION (TAA) VIEWS & PERFORMANCE

Source: Bloomberg. Assuming a 6% annualized yield for cash.

GLOBAL ASSET PERFORMANCE SNAPSHOT

Source: Bloomberg Equity/Fixed Income Returns/Yields in local currencies. Commodities in USD. Numbers for Fixed Income are Yields. As of April 30, 2022.

ROUTES TO MARKETS: MODEL ALLOCATIONS