The world averted the major crises of last month to continue marching ahead. Most developed countries reported economic recovery as seen from the improvement in high-frequency PMI, unemployment, wages, retail sales, and industrial activity data supported by progress of vaccination campaigns.

GLOBAL MACRO: GROWTH RECOVERY FACE-OFF WITH RISING INFLATION

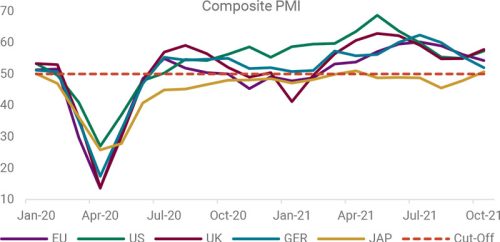

The world averted the major crises of last month to continue marching ahead. Most developed countries reported economic recovery as seen from the improvement in high-frequency PMI, unemployment, wages, retail sales, and industrial activity data supported by progress of vaccination campaigns. New mobility restrictions were limited, with China and Russia being the exceptions due to the rise in localised Covid cases. Congress averted the debt ceiling crisis in the US by pushing the deadline to Dec-21, and Biden made some headway on his infra spending plans. Even as Evergrande debt default was avoided at the last minute, power outages impacted China’s GDP growth for the Sep quarter. A mix of continued supply chain bottlenecks and surging commodity prices have led to prolonged inflationary pressures and concerns around it being more persistent than expected. CPI readings have spiked to decade highs across many economies, forcing central bankers and economic advisors to consider these evolving growth and inflation dynamics in their response to policy normalisation as we enter the post-pandemic era.

Composite PMI for major developed economies in expansion zone

Source: Bloomberg

GLOBAL EQUITIES: AT FRESH PEAKS

Stocks posted a sharp V-shaped rebound from Sep lows to hit all-time highs in Oct-21. Equities showed a lot of resilience despite many concerns around logistical disruptions, semi-conductor, labour shortages, and associated input cost increases. Rising optimism on macro combined with a solid show from corporates has revived market sentiments. 80% of the US S&P 500 companies that have reported earnings surprised on the Street estimates once again. Even Chinese indices bounced back post huge underperformance CY21TD as investors seem to have priced the appropriate risk premium for the regulatory oversight. The current macroeconomic backdrop of above-trend growth and declining liquidity provisions favours value over growth. Thus, we have tactical OW on Europe and Japan and a Neutral stance on the US. Investors who wish to adopt a “wait and see” approach and seek greater clarity on Chinese policy can build some cash position by going UW on Asia ex-Japan and EM to buy into cheaper valuations down the road.

Inflation is turning out to be persistent than transitory

Source: Bloomberg

GLOBAL FIXED INCOME: BEAR FLATTENING; OW HIGH YIELD

The volatility shifted from Equities to Debt markets in Oct-21 as treasuries felt tremors, especially at the short-end of the yield curve. The US 10-year had spiked by ~20bps to 1.7% at one point, but 2-year yields almost doubled in less than a month. Similar moves were witnessed across regions causing interest rate curves to flatten sharply. Markets are signaling the US Fed for an early lift- off given the building up of longer-lasting price pressures. But the US 30-year is rather down 40-50bps from its last peak in Apr-21. This implies the markets are discounting peak rates in this rate hike cycle to be way lower than earlier cycles as they seem to have lowered their growth projections. The US Fed is expected to announce tapering at its upcoming Nov-21 FOMC meeting with a view to end it by mid-2022 followed by gradual hiking from end-2022. The ECB reiterated its view on inflation as transitory and postponed its decision on asset purchases to Dec-21, in the wake of the PEPP coming to an end. Retain OW on HY relative to IG and Sovereign bonds, but as HY spreads have narrowed sharply, investors could look at low beta long-short equity funds and zero beta market neutral products as well.

Yield curves across regions are flattening

Source: Bloomberg

GLOBAL COMMODITIES: COAL TANK, OIL ZOOM; RETAIN OW GOLD

Oil rallied to multi-year highs in the last week of Oct-21, helped by post-pandemic demand rebound and the OPEC+ sticking to gradual increases of 400,000 bpd, despite calls for more oil. On the other hand, Newcastle coal prices, a benchmark for the global market, dropped by over 30% on 1-Nov-21, following a steep decline in the Chinese prices driven by a government crackdown. Towering fossil fuel prices are also due to lack of new capacity building driven by decarbonization, green energy, climate change and ESG activism. Gold is now looking attractive on valuations vs Oil, Copper and Silver and as a hedge against persistent high inflation. Thus, retain tactical OW on Gold.

Demand-supply mismatch drove energy prices higher

Source: Bloomberg

INDIA MACRO: BILLION DOSES BOOSTS CONFIDENCE ON ECONOMIC PROGRESS

After China, India became the second country to administer over 1 billion vaccine doses, with almost 54% of the Indian population now vaccinated with the first dose (70% adults) and ~24% of the people fully vaccinated (33% adults). However, the government is yet to vaccinate 100 million people who have not been administered their second dose after the prescribed interval, in addition to the population in districts with low vaccine coverage being targeted via the newly launched door-to-door campaign. Mobility trends are almost back to pre- Covid levels, with both workplace and retail & recreation now just 5% under the Feb-20 benchmark. The divestment plan for Air India has been set into motion, with Tata Sons’ INR 180bn offer for 100% of the debt-laden and loss-making carrier being accepted by the government. GST collections came in strong at INR 1.3tn in Oct-21, the second-highest monthly collections since GST was implemented, supported by formalization, improved compliance measures, and healthy pre-festive season stocking. The GST collections for Nov-21 are expected to be even higher than last month, as signaled by the lead indicator of E-way bills for goods transportation rising to an all-time high of 73.5mn vs the last peak of 71.2mn seen in Mar-21.

India’s Composite PMI rose to 58.7 in Oc-21, capturing its most robust monthly expansion in nearly a decade, with the broad-based acceleration seen across manufacturing and service sectors. However, 2W sales of Auto OEMs witnessed a subdued performance in Oct-21 due to rising fuel prices and healthcare costs impacting rural demand. At the same time, the PV segment delivered below-par performance caused by chip shortages, although with a slight MoM improvement from a relative easing of production constraints. Rabi sowing has begun well, with high reservoir levels poised to support the season.

India’s progress on vaccination has been remarkable so far

Source: Our World in Data

GST collections at second highest post implementation

Source: Bloomberg

INDIA EQUITIES: NERVOUS JITTERS; STAY OW EQUITY / RETAIN OW MID

Indian indices soared to record highs but hit a wall in mid-Oct to give up all gains. It appears to be a classic case of profit booking led by edgy nerves at market tops or could be liquidity creation to participate in booming primary markets. INR 300bn worth of offerings are lined up in Nov-21, taking the total capital raised from IPOs to new highs – and this without accounting for the massive LIC IPO. Few foreign brokerages also downgraded India Equities to Neutral from Overweight, considering frothy valuations and downside risks to growth post-pent-up and festive demand. 2QFY22 earnings have been mixed so far, with revenues surprising on the upside due to final product price hikes but operating margins disappointing due to input cost increases. Management commentary has also highlighted the raw material inflation as unprecedented and at multi-decade high levels. Equities are attractive vs. Bonds, supported by improving macro-outlook, healthy EPS growth, and strong liquidity support. Even as the valuation gap has narrowed between Mid-caps and Large-caps, DII flows and high retail activity favour Mid-caps. Investors can take satellite positions in short-term thematic opportunities with a 6-12-month view.

Corporate profits/GDP on an upswing and expected to trend higher

Source: ACE Equity, Bloomberg

INDIA FIXED INCOME: FOCUS ON DRAINING LIQUIDITY; OW CORP / SHORT TERM

In line with expectations, RBI announced measures to normalise liquidity at its Oct-21 MPC meeting. The size and tenor of the VRRR auctions was further raised along with discontinuation of the GSAP. The RBI stuck to its GDP growth guidance at 9.5% for FY22 but lowered inflation estimates from 5.7% to 5.3% basis benign food prices. It also kept status-quo on rates and retained accommodative stance with a 5:1 vote sticking to its pro-growth focus. Pick up in energy and commodity costs have raised the spectre of imported inflation. Global central bank tightening and commentary around rate movements drove OIS curves sharply higher, pointing to sequential repo hikes in FY23. We believe RBI could do reverse repo hikes in Dec-21 policy followed by change in stance in Feb-22 before it embarks on the path of gradual repo hikes. Due to the tax buoyancy witnessed on the direct and indirect taxes front and Govt’s. tight leash on expenses, FD came in at a meagre 35% of BE for the 1HFY22. If divestments do proceed as planned, FD could come in lower than the budgeted 6.8% for FY22. Given that yield curve flattening is going to be led rising front-end rates, matching duration with investment horizon has become even more important. We prefer top-quality corporate issuances/funds and short-duration investments for debt allocations while avoiding G-Secs and long duration.

OIS curves pricing in a steeper and quick rate hike cycle

Source: Bloomberg

CURRENCY: USD COULD WITNESS SLIGHT TRACTION OVER NEAR TERM

On a real basis, the INR has weakened vs. a broad basket of currencies in Oct21. Surprisingly, on a nominal basis, INR weakened even more despite India’s CPI softening sequentially in Sep-21 to 4.4% vs. 5.3% in Aug-21 (hardening inflation typically should depreciate currency). Perhaps, markets are looking forward as they seem to be factoring in some probability of a rate hike one year down the line, with the 1Y-OIS breaching the repo rate even as inflation moderated. Preliminary export-import data indeed suggest a resilient Indian economy as exports outstripped imports for the fortnight of Oct-21. World-over though, central banks are in hike mode, thus making the USD attractive from a carry perspective. Technically, MACD and moving averages net-net tip the scales overall, in favour of the USD.

Crude Oil and Commodity price inflation has pushed up trade deficits

Source: Bloomberg

TACTICAL ASSET ALLOCATION (TAA) VIEWS & PERFORMANCE

Source: Bloomberg. Assuming a 6% annualized yield for cash.

GLOBAL ASSET PERFORMANCE SNAPSHOT

Source: Bloomberg Equity/Fixed Income Returns/Yields in local currencies. Commodities in USD. Numbers for Fixed Income are Yields. As of 31 st October 2021.

ROUTES TO MARKETS: MODEL ALLOCATIONS