Key advanced economies have progressed well on curtailing the Delta wave with rapid inoculations. Further, plans of booster shots for adults and vaccines for youth could soon see these countries entering the “pandemic to endemic” phase of the virus

GLOBAL MACRO: DELTA ON THE WANE BUT SUPPLY ISSUES WREAK HAVOC

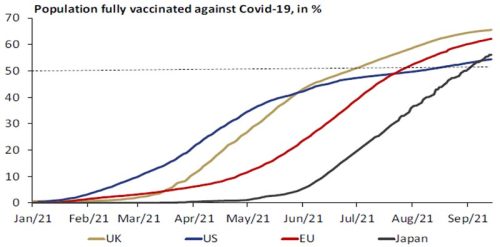

Key advanced economies have progressed well on curtailing the Delta wave with rapid inoculations. Further, plans of booster shots for adults and vaccines for youth could soon see these countries entering the “pandemic to endemic” phase of the virus unless existing Variants of Interest like Mu and Lambda become Variants of Concern, and current vaccines end up being ineffective. Merck’s recent update on an oral pill, Molnupiravir, could thus turn out to be a game-changer as safe, well-tolerated, affordable, and easy-to-administer antivirals are ideal treatments to counter the virus directly. Even as the World grapples with this ongoing health crisis, supply chain disruptions that emanated from it last year have led to an imminent energy crisis. This has resulted in power outages impacting business activity globally, as seen in PMI data, primarily industrial production in China. The Evergrande debacle added to the growing list of woes, forcing GDP downgrades, and complicating mid-cycle transition. With inflation inching higher due to commodity prices, stagflation concerns have started to emerge, which we believe are exaggerated.

Key Advanced Economies have exceeded a 50% full vaccination rate

Source: Our World in Date; LGT

GLOBAL EQUITIES: CONTAGION RISKS SPOIL THE PARTY

Equities entered Sep-21, firing on all cylinders but nervousness around Evergrande knocked the wind out of the market’s sail. Potential default by the most indebted Chinese company is a significant event, especially when it pertains to the property sector, as it constitutes 60% of Chinese household assets, 40% of total banking advances, and 30% of its GDP. But, unlike GFC, this episode does not look like a systemic failure, as capital controls have limited the risks of contagion. Undoubtedly, the pace of expansion in China could slow down, affecting its key trading partners, but the authorities could employ various policy levers to contain the downside risks. The possible spillover effects spooked investors leading to a sharp spike in the VIX indices. US Fed’s guidance around Nov-21 tapering further dampened the enthusiasm as growth stocks came under pressure from rising bond yields. The wealth effect from soaring house prices and likely unleashing of huge savings are key medium- term triggers. We retain our tactical OW stance on Europe and Japan and stay Neutral on the US. Investors who wish to adopt a “wait and see” approach and seek greater clarity on Chinese policy can build some cash position by going UW on Asia ex-Japan and EM to buy into cheaper valuations down the road.

Globally, house prices have surged on solid demand post-pandemic

Source: JP Morgan; LGT

The Federal Reserve officials’ quicker than expected withdrawal of stimulus by mid-2022 and aggressive interest rate hike projections caught everyone by surprise as it was faster than what markets had discounted. In the UK, the BoE also hinted at raising rates in early 2022 due to surging inflation, even before QE is fully wound up, even as weakening growth momentum could pose some difficulty. The ECB, on the other hand, did announce a reduction in the pace of asset purchases under the PEPP but was in no hurry to take it down to zero. Many of the OECD and G20 nations’ central banks have already raised key policy rates. Contrary to all of them, the PBOC might have to resort to more easing to backstop local growth. Retain OW on HY relative to IG and Sovereign bonds, but as HY spreads have narrowed sharply, investors could look at low beta long-short equity funds and zero beta market neutral products as well.

US inflation has surprised on the upside, with the surge now losing steam

Source: Citigroup; LGT

GLOBAL COMMODITIES: ‘POWER’FUELED RALLY; RETAIN OW GOLD

China’s power-hungry commodities producers are in Beijing’s firing line, but the government’s efforts to stave off a full-blown energy crisis are also fueling rallies in everything from fertilizers to silicon. Gas prices further rallied with China and Korea wanting to secure winter supplies due to supply disruptions in US LNG, Oman, and Malaysia. At the same time, a 77% volume drop in Yamal – Europe pipeline drove NBP prices to a record high. OPEC+ stuck to its planned moderate increase in output for Nov-21 despite the market expectation that the alliance would further boost production to alleviate soaring crude prices. Globally, VIX has moved up sharply from mid-Sep along with Citi risk indices, supporting our view on Gold as a risk-off trade. Retain OW on Gold.

Gas prices are on a tear led by supply disruptions but strong demand

Source: Bloomberg

NDIA MACRO: BRIGHTENING PROSPECTS

With over 910 million total doses of vaccines administered so far and ~70% of the eligible population receiving at least one dose of the vaccine, the government’s inoculation drive has sustained its momentum. However, with only 26% of the adult population fully vaccinated and the festive season nearing, the foot cannot be taken off the pedal. Mobility data suggests improvement above pre-2nd wave levels but not yet back to pre-Covid levels. In another bid to boost India’s manufacturing and employment, the government approved PLI schemes for three sectors – auto and auto components, textiles, and drones. They also announced a much-awaited relief package for the telecom sector comprising structural and procedural reforms, the primary one being a moratorium on payments of all government dues. Progress has been made towards the government’s arduous disinvestment targets of INR 1.75tn for FY22, with Tata Sons likely to win the bid for Air India, and LIC having appointed merchant bankers for its IPO with the DRHP to be filed by Nov-21. Additionally, the RBI has provided the NARCL a license to set up and operate the “Bad Bank” to take over and dispose of stressed assets worth INR 2tn of commercial banks. The government has guaranteed the security receipts issued by NARCL.

India’s Composite PMI was relatively steadfast at 55.3 vs. 55.4 in the previous month, led by expansion in both manufacturing and services output. Surging industrial power demand, widening spread between domestic and global coal prices, and seasonal monsoon impact on domestic production have contributed to a severe nationwide coal shortage in line with international developments. GST collections came in at Rs 1.17tn in Sep-21, 22.5% higher YoY, maintaining a healthy trend in the second quarter. Auto OEMs reported mixed numbers as 2W, and CVs surprised positively, while PV volumes were hit due to supply chain constraints. Monsoons ended the season in line with the LPA for third time in a row, recovering from a 10% negative deviation at the end of Aug-21.

Low cases and healthy vaccination pace have eased restrictions

Source: Our World in Data

Normal monsoons hattrick – Aug drought made good by Sep deluge

Source: CMIE

INDIA EQUITIES: UNPARALLELED; STAY OW EQUITY / RETAIN OW MID

The upswing continued through Sep-21 as the bull market gobbled up many bears at one go – liquidity tapering, raw material shortages, low global growth but high inflation, and even Evergrande. Equity markets did feel some jitters as volatility shot up, and they wobbled a bit in the last week but ended the month in green. The breadth of the market was solid owing to wider participation from many sectors and across market caps. Hitherto underperforming sectors like Media, Communication Services, FMCG, Power Utilities, Financials, and PSU hugely contributed to the rally. Real Estate and IT continued with their excellent act. MSCI India’s premium to MSCI EM surged to a decade-high 85%, driven by an outstanding performance from Indian indices and weakness of MSCI China due to regulatory actions. As markets seem priced to perfection, the most significant risks are a disappointment on macro recovery due to any potential Covid waves and corporate earnings due to inflation. Despite high valuations, Equities look attractive relative to Bonds, given positive real yields, favourable macro outlook, solid EPS growth, and strong liquidity support. We prefer Mid- caps over Large-caps within Equities led by relatively better valuations, higher forward EPS upgrades, and momentum indicators. Investors can take satellite positions in short-term thematic opportunities with a 6-12-month view.

Equity penetration is making inroads in all directions

Source: NSE

INDIA FIXED INCOME: RBI GUIDANCE HOLDS KEY; OW CORP / SHORT TERM

All ears would be tuned to the RBI’s bi-monthly commentary come 8-Oct-21. As RBI has already increased the size and cut-off rates of VRRR auctions as a first step towards gradually normalising the exceptional liquidity measures undertaken to deal with the pandemic, some economists are expecting a reverse repo rate hike at the Oct-21 meeting. We expect a status quo on the policy rates and continuation of accommodative stance given inflation is evolving as per RBI’s projections. Though the economy has bounced back, recovery is still uneven, and the credit cycle is weak. So nurturing growth would remain a policy priority. An update on the quantum of G-Sec purchases under GSAP would also be keenly watched. The government finances are in good shape, with fiscal deficit contained at 31% of BE for Apr-Aug and H2FY22 borrowing calendar kept unchanged. Moody’s retained India’s sovereign rating at the lowest investment grade (Baa3) but revised its outlook from Negative to Stable. We prefer top-quality corporate issuances/funds and short duration investments for debt allocations while avoiding G-Secs and long duration.

Corporates across many sectors have deleveraged in the last five years and are now better positioned to undertake capex

Source: CARE Ratings

CURRENCY: BALANCING FACTORS IN PLACE; TURN NEUTRAL ON USD-INR

The dollar index has rebounded and is now trading above its key moving averages. The USD has also rallied against most currency pairs in Sep-21. The outlook on the USD is balanced by two opposing factors: 1) expectations of tighter financial conditions in the US via Fed tapering that would cause the dollar to rally and 2) relatively higher economic growth in the Eurozone over the near term favours the EUR. Moreover, lower twin deficits than the US, negligible inflation differential, better current account and external debt position, FII/FDI flows, and record-high FX reserves offer confidence that INR volatility will be much lower than the 2013 tantrum. Hence, we turn Neutral on USD-INR pair.

Taper impact – DXY index has bounced from lows, with USD rallying against all major currencies

Source: Bloomberg

TACTICAL ASSET ALLOCATION (TAA) VIEWS & PERFORMANCE

Source: Bloomberg. Assuming a 6% annualized yield for cash.

GLOBAL ASSET PERFORMANCE SNAPSHOT

Source: Bloomberg Equity/Fixed Income Returns/Yields in local currencies. Commodities in USD. Numbers for Fixed Income are Yields. As of 30 th September 2021.

ROUTES TO MARKETS: MODEL ALLOCATIONS