Even as Delta variant disrupted mobility and dented business activities mainly in the developing world, advanced economies continued with their re-openings (except Japan) aided by high levels of vaccinations.

GLOBAL MACRO: ON THE PATH TO NORMALISATION

Even as Delta variant disrupted mobility and dented business activities mainly in the developing world, advanced economies continued with their re-openings (except Japan) aided by high levels of vaccinations. US, Europe, and the UK see high-frequency real-time indicators like Services PMI and retail sales stabilising above pre-pandemic levels. Employment data and wage growth are also showing improvement towards pre-Covid trends. After posting solid growth in 2020, China’s economy seems to have hit a wall led by recent lockdowns and a tightening of credit supply earlier this year. How to get the households to spend more is a big puzzle facing the Chinese government. Studies from the UK and Israel suggest antibody protection from the vaccine wanes after six months – though it remains against severe disease, critical hospitalization, and death. As a result, few countries have announced booster programs to inoculate masses with a third dose. With large populations in Africa and Latin America still awaiting their first dose, this exercise will only widen the gap between the haves and the have-nots exacerbating the K-shaped recovery seen so far.

Vaccines are still efficacious against severe disease and fatality

Source: JP Morgan; LGT

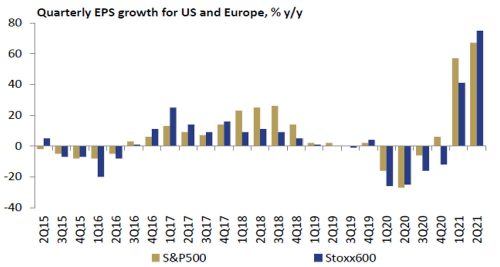

GLOBAL EQUITIES: ALL GUN’S BLAZING

Supervisory actions continued in China, with a broader swathe of industries and sectors having to bear the brunt. A loss warning from Evergrande New Energy Vehicle led to the world’s worst rout – a massive $80bn drop in its market value, i.e., >90% gone in a few months! It highlights the importance of fundamental analysis and how not to get swayed by trending topics on investor forums. EMs took a slide down in the first half of August on rising cases and supply constraints but managed to post a decent monthly gain in the end. DM Equities surged higher on solid earnings growth, continued economic revival, a strong labour market, and a lower-for-longer rate stance. Inflation readings remained elevated globally. With DM indices at new highs, investors need to fasten their seat belts to guard against unannounced episodes of volatility. In this phase of the bull cycle, where peak earnings growth seems to be behind us, it will be prudent to be selective and focus on quality. We retain our tactical OW stance on Europe and Japan and stay Neutral on the US. With Fed tapering on the horizon and broad regulatory changes in China, investors who wish to adopt a “wait and see” approach on risk assets can build some cash position by going UW on Asia ex-Japan and EM to buy into cheaper valuations down the road.

Corporate earnings have shown strong recovery

Source: JP Morgan; LGT

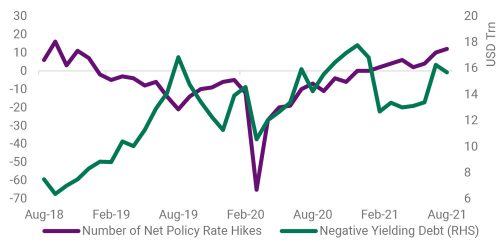

GLOBAL FIXED INCOME: A TAPER WITH NO TANTRUM; OW HIGH YIELD

Going into August, all eyes were on the annual Jackson Hole Symposium for central bankers’ views and comments on the direction of easy money policy. US Fed Chair Powell maintained a delicate balance by decoupling tapering from tightening. He stated that macro conditions had reached a stage that warrants a reduction in the pace of bond purchases by the end of 2021, but “there’s much ground to cover” for an interest rate liftoff. Due to rising inflation concerns, which it believes to be not transitory, the BOE too gave a detailed framework by which it will withdraw its policy support. On the contrary, the PBOC, the first of the central banks to curtail liquidity last year in the face of a roaring recovery, cut the BRRR by 100 bps (with readiness to do more) as the Chinese economy is challenged with a slowdown. Retain OW on HY relative to IG and Sovereign bonds, but as HY spreads have narrowed sharply, investors could look at low beta long-short equity funds and zero beta market neutral products as well.

Many small central banks have hiked rates to temper inflation, but negative yielding debt is still high, as large banks are on hold

Source: Bloomberg; cbrates.com

GLOBAL COMMODITIES: THE STORY OF TWO OILS; RETAIN OW GOLD

Edible oil prices have been on a tear as the primary producers have been struck either by climate change or the pandemic. On the other hand, Crude oil prices fell as OPEC and its allies agreed to stick to their existing policy of gradual oil output increases amid calls from the US to increase crude supply more quickly. In addition, supply disruption caused by hurricane Ida resulted in elevated prices for natural gas. Aluminum rallied 11% in the past three months and is now up 54% YoY. The spot prices have hit a 10-year high driven by supply concerns, as Chinese smelters face stricter power controls. With negative-yielding debt again surging and net contracts rising MoM, we retain OW stance on Gold.

Global food prices have delivered a nasty surprise

Source: Food & Agriculture Organization

INDIA MACRO: FESTIVE SEASON UP AGAINST A POTENTIAL THIRD WAVE

The nationwide vaccination drive is garnering pace, with the looming threat of yet another Covid-19 variant and the potential third-wave outbreak. Having administered over 180mn doses in Aug-21, which is more than what all G7 nations managed for the same period, nearly 40% of the Indian population has now received at least one dose of the vaccine. FM unveiled the government’s INR 6tn National Monetisation Pipeline (NMP) to fund its ambitious infrastructure projects under NIP partly. Sectors like Roads, Railways, Power, Oil & Gas pipelines, Telecom, etc., will be monetised over the next four years, with ~15% of assets expected to roll out in FY22 itself. The government also announced the removal of Retrospective Tax by amending tax laws to do away with demands for past payments and settling international payments running into billions of dollars. Q1FY22 GDP recorded a growth of 20.1% (in line with consensus) against -24.4% in Q1FY21 and +5.4% in Q1FY20. The fiscal deficit also came in at INR 3.2tn for the Apr-Jul period, at just 21% of the budgeted estimates for FY22. Receipts came in strongly, driven by tax and non-tax revenues, whereas expenditures were curtailed significantly, mainly in Jul.

Services PMI bounced back to 56.7 in Aug-21, which was led by reopening several establishments and a substantial increase in domestic demand. However, the Manufacturing PMI moderated a bit along with a sharp rise in input costs. GST collections for the month came in above INR 1.1tn, with an uptrend likely to sustain. Indian Railways also witnessed an increased momentum with record high freight loading and earnings in Aug-21, driven by growth in coal, cement, iron ore, and food grains. Supply-side constraints due to the global semi-conductor shortage caused a sequential decline of more than 20% in PV wholesales for OEMs. However, demand sustained with low inventory levels and high outstanding bookings. Monsoons ended Aug-21 10% below LPA, but Kharif sowing has not seen much impact except a few crops like cotton.

Daily vaccination rate is trending up sequentially

Source: Our World in Data

GDP up 20.1% YoY in 1QFY22 but still below 1QFY19 levels

Source: Bloomberg

INDIA EQUITIES: BREAKING ALL BARRIERS; STAY OW EQUITY / RETAIN OW MID

Bulls went on a rampage on Dalal Street, taking the benchmark Nifty and Sensex to all-time highs as Large-caps outperformed Mid and Small caps by an extensive margin. Broader indices witnessed sharp correction right from the start of August, and even as the Mid-cap index closed the month in green, the Small-cap could not. The magnitude of the divergence caught many traders by surprise and led to massive erosion in individual portfolios. Retail participation fell steeply from 66% to 58% MoM to align to the medium-term average of 57%. India is a shining star amongst EMs with its economy holding up, vaccinations picking up pace, corporates reporting better than expected results, improving consumer confidence, and business hiring activity. The immediate concerns are potential Covid third wave, slower demand recovery, and margin pressure from rising input prices. The lofty equity valuations have incrementally compressed the margin of safety, and any disappointment on the earnings front could be concerning. But, given negative real yields for bonds, solid EPS growth, and liquidity support for equity, we retain OW on Equity vs. Bonds. Post broader market meltdown, relative valuations have become much better for Mid vs. Large caps. Hence, we keep OW view on Mid-caps, further aided by higher forward EPS upgrades and technical indicators. Investors can take satellite positions in short-term thematic opportunities with a 6-12-month view.

Healthy EPS growth forecasts are seen across the board

Source: Bloomberg

INDIA FIXED INCOME: A HAWK AMONGST THE DOVES; OW CORP/ SHORT TERM

RBI’s Aug-21 MPC meeting kept rates on hold and voted with a 5:1 majority to retain the accommodative stance – Prof. Varma, an external member, was the lone dissenter. “Monetary accommodation appears to be stimulating asset price inflation to a greater extent than it is mitigating the distress in the economy,” were his brave words. He believes growth in many sectors has revived to pre-Covid levels and fiscal policy, not monetary, is a better tool to provide relief to the still affected segments. He also thinks it is time to raise the reverse repo rate to signal RBI’s commitment to the inflation target as its come-what-may pro-growth stance has led to entrenched inflationary expectations. RBI believes underlying conditions are still weak and hence, support from all sides is necessary to nurture the nascent and hesitant recovery. It also announced Calibrated increase in absorption of liquidity under VRRR. We like top-quality corporate issuances/funds and short-duration investments for debt allocations while avoiding G-Secs and the long end of the curve.

Tax Revenues have grown significantly led by corporate taxes and customs and excise duties

Source: CMIE

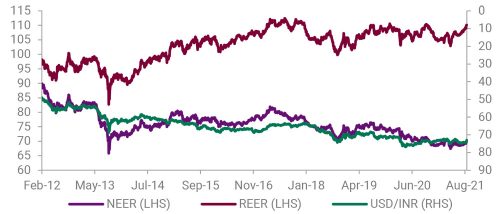

CURRENCY: FLOWS AND STUBBORN US CPI SHOULD FAVOUR INR

India’s REER has given a break-out likely boosted by FDI inflows of $22.53 bn during Q1FY22. After Jackson Hole, US 10Y hardened, implying a re-stoking of US inflation, and USD also fell as interest rate parity prevailed. In the future, we can expect some weakness as this effect typically lasts longer than (the counter-opposing) shorter-term carry trade. US-India inflation differential is also relatively narrow at the moment but could widen ahead if US CPI moderates and India CPI remains elevated. Compared to 2013, the FX reserves to imports ratio is significantly high. Thus, the risk of a repeat of heightened INR volatility during taper tantrums could be limited. Hence, we shift OW to the INR vs. USD.

REER has shown strong upward bias likely on account of DIIs, FIIs and FDI chasing nearly all Indian assets (primary/secondary equities/debt)

Source: Bloomberg

TACTICAL ASSET ALLOCATION (TAA) VIEWS & PERFORMANCE

Source: Bloomberg. Assuming a 6% annualized yield for cash.

GLOBAL ASSET PERFORMANCE SNAPSHOT

Source: Bloomberg Equity/Fixed Income Returns/Yields in local currencies. Commodities in USD. Numbers for Fixed Income are Yields. As of 31 st August 2021.

ROUTES TO MARKETS: MODEL ALLOCATIONS