Economic recovery is accelerating especially for DMs as seen from high frequency indicators like PMI, factory activity, property registrations, trade flows, payroll, and employment data.

GLOBAL MACRO: FUNDAMENTALS ARE CATCHING UP

Economic recovery is accelerating especially for DMs as seen from high frequency indicators like PMI, factory activity, property registrations, trade flows, payroll, and employment data. US and China’s broad-based strength has been at the forefront with Eurozone and Japan playing second fiddle. Global Manufacturing PMI is at its best reading in a decade despite renewed wave of infections and fresh lockdowns in many regions. But Services which were already lagging could falter more. With goods demand outstripping supply, input and output prices have seen steep rises stoking inflation fears. The Suez Canal episode uncovered another weak link in the global supply chain sharply pushing up ship freight rates. But once temporary factors recede, goods price pressure should ease in coming months and help offset higher services inflation expected in latter half of this year. Given this, real GDP growth forecasts for 2021 are getting upgraded every month. Progress on vaccinations and existing fiscal programs hold key. Any additional stimulus will offer further support. Biden’s

$2.3tn ‘Infra Plan’ – funded by tax hikes – is one of few proposals in pipeline.

Virus reproductive rates (R0)* in key economies have fallen

Source: Our World in Data, LGT, *An R0 value below one means that a virus is effectively no longer spreading in a community.

GLOBAL EQUITIES: ON THE MOVE; OW EU/JAPAN

The new highs of few global equity indices in Mar-21 made it aptly clear that a rise in bond yields due to a recovery in growth will not derail the bull market at least for the advanced economies. But improving real rates in DMs and strengthening dollar index could weaken the case for EMs (primarily those that depend on cheap USD funding) which were in a sweet spot post US elections and commodity reflation trade. The blow-up at Archegos Capital once again highlighted the risks that accompany leverage (CFD) and why it pays to be patient in long-term wealth creation. It also poses hard questions to all market participants – How could all the banks (Nomura and Credit Suisse being the most affected ones) due diligence and risk management frameworks fail at the same time or were they non-existent in the first place? Have they forgotten the learnings from 2008 GFC when CDS attained infamy? Is this issue an isolated one or is a systemic crisis brewing? When huge liquidity is sloshing around, some of it ends up in such financially engineered ideas that could entail bigger risks – SPACS is the other one. It always pays to be prudent and more so now.

We maintain our tactical OW stance on EU/Japan (Value) and stay Neutral US (Growth) as the former regions also have relatively stronger EPS forecasts.

G-4* economies on their way back to trend growth this year

Source: Deutsche Bank, LGT

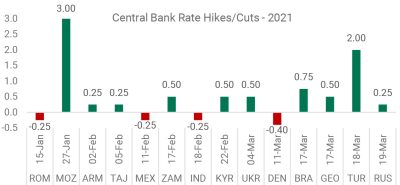

GLOBAL FIXED INCOME: TRACKING THE SIGNALS; OW HIGH YIELD

Continuing with their dovish stance, ECB increased bond purchases to keep borrowing costs from rising steeply. The US Fed was also unfazed by the sharp spike in 10Yr US Treasury and assigned the move to stronger economy. It raised US real GDP growth forecast to 40-year high of 6.5% YoY while expecting unemployment to decline from current 6% to 4.5% and 3.5% by end of 2021 and 2022, respectively. The Fed does not expect inflation to be sustainably above target and to raise rates before 2024. Such ultra-loose policy despite a booming economy has led to market fears of earlier-than-guided scale back. A reversal in accommodative positioning by a few central banks – Turkey, Brazil, Russia – have added to these concerns. Adverse local developments forced them to act to support their own currencies and combat inflation. China too has sounded caution by reining in excess liquidity and credit impulse. We retain our tactical OW on HY bonds relative to IG and Sovereign bonds.

Adverse local developments have forced few central banks to hike rates

Source: cbrates

GLOBAL COMMODITIES: MIXED COMPLEX; 1 NOTCH LESS OW ON GOLD

The commodity complex had a soft month in Mar-21 largely on the back of some cooling down of Crude Oil as the Ever Given was finally refloated. The ship was stranded for 6 days and estimates peg a daily disruption of ~$9bn worth of goods! Semiconductor shortages have piled up and concerns have now been raised about livestock, corn and soyabean price surge. Gold has been on a downward trajectory since Aug-20 making its valuations now attractive vs. rising industrial metals like copper. Improving risk sentiments have also led to a drop in ETF holdings and net contracts, thus lowering our OW stance on Gold.

Gold Net Contracts have suddenly dropped below 3/5Yr average levels

Source: Bloomberg

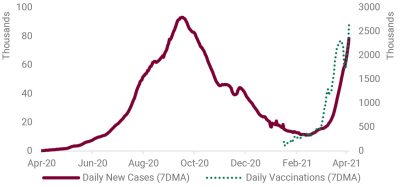

INDIA MACRO: A RACE BETWEEN INJECTIONS AND INFECTIONS

With the onslaught of the 2nd wave of Covid-19 infections, India crossed the grim one-lakh figure in new infections for the first time since the pandemic began. At the current rate, it is looking to replace Brazil as the second-worst hit country by number of cases. While the current spurt is more rapid, it is not as widespread and fatal as the 1st wave, with Maharashtra witnessing 60% of the daily cases. That has led the state to resort to mobility restrictions and partial lockdowns to curb transmission of the virus. Since the start of the vaccination program on 16-Jan, India has administered almost 80mn doses with over 10.4mn people now being fully vaccinated, however that is only 0.7% of the country’s population – emphasizing the need for raising awareness and conduct speedy, broad-based, and efficient vaccination drives. The third phase of the vaccination drive, which makes everyone above the age of 45 eligible for the jab, should see a strong demand for the vaccine and likely quicker rollout to the rest of the population as well. Some way to go before we can breathe easy.

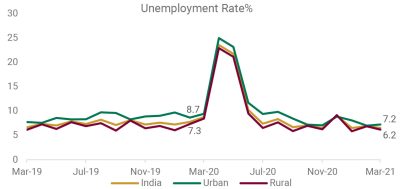

GST collections saw a 6th consecutive month of steady collections above the INR 1tn mark, coming in at INR 1.24tn – the highest ever. Automobile OEMs reported healthy sequential volumes across segments for Mar-21 with Tractor, PV volumes continuing their momentum and CV, 2W surprising positively. The Manufacturing PMI came in at 7-month low at 55.4 vs 57.5 in the previous month, as the manufacturing sector conditions improved, despite showing some loss of growth momentum. The unemployment rate in the country declined to 6.5% in Mar-21 from 6.9% in Feb-21. While urban unemployment rates increased in Mar-21, rural unemployment saw a decline. As per CRISIL, risks on the horizon are a 2nd round of widespread lockdowns, delays in implementing budget measures and a weak monsoon.

2nd wave gathers pace in India – daily cases > last peak of Sep-20

Source: Our World In Data

Unemployment has recovered to better than pre-Covid levels

Source: CMIE

INDIA EQUITIES: IN A TIGHT RANGE; OW EQUITY / MID CAPS

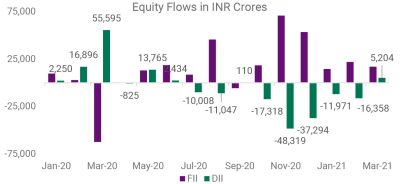

Equity indices did not go anywhere in the last month of the fiscal year 2021. First, the soaring bond yields impacted market sentiments, then came mounting Covid cases and lastly primary offerings sucked out liquidity almost every week. Markets had bottomed out last March which also led to profit booking from Retail + HNI investors. But reassurance of liquidity support from central banks, US stimulus programs and more headway on vaccinations locally, limited the drawdowns. The benchmarks are in consolidation phase facing resistance at the top and support at the bottom. 4Q results will provide some direction. There was a bit of a wobble in the IPO market too as few offerings listed at a discount to issue price. The marked change was DII’s turning net buyers in Equity after 8 consecutive months of being net sellers. AMFI data will reveal if tax savings (ELSS) drove the inflows or fence sitters turned buyers by seeing a 15-20% discount to recent highs on many stocks.

Improving macro and micro dynamics, rising inflation and liquidity support our OW Equity thesis. Elevated valuations are a concern and hence staggered buying-quality-on-the-dips approach would yield better results. We retain our OW stance on Mid vs Large-caps led by higher EPS upgrades and retail + DII participation but lessen conviction due to technical momentum favouring Large.

As stated earlier, satellite positions could be considered in short term thematic opportunities like PLI, Infra, Value, EV, IT Services with a 6–12-month view.

DIIs (MF + Insurance + Pension) turned net buyers after a long time

Source: Bloomberg

INDIA FIXED INCOME: FRAYING THE NERVES; OW CORP / SHORT-TERM

Despite RBI’s calming forward guidance, it had to devolve five bond auctions in a row in Feb as investors were unwilling to accept low yields given budgeted borrowings. In its latest state of the economy report, RBI has scolded bond vigilantes for their adventurism as it could “undermine economic recovery and unsettle buoyant financial markets”. The upcoming MPC meet is expected to maintain status-quo on rates and stance. The normalisation measures are likely to be pushed forward due to rising Covid cases making the commentary on growth, inflation and OMO’s interesting to watch. The Govt. has extended the existing inflation targeting bands by 5 years till FY26 as it worked well. 1HFY22 borrowing calendar at INR 7.24tn (60% of FY22) is front ended in line with past years. In a show of good politics vs bad economics, FM reversed large rate cuts in small savings schemes by calling it an “oversight”. After 6 quarters, the credit UG/DG ratio has moved >1 and CRISIL expects it to last through FY22.

We like top quality corporate issuances / funds and short duration investments for debt allocations while avoiding G-Secs and long end of the curve.

CRISIL expects more upgrades than downgrades in FY22

Source: Bloomberg

CURRENCY: USD – ONCE A SAFE-HAVE, NOW RISK-ON; OW USD vs INR

The dollar index seems to be recovering smartly as the Biden administration announced a massive $1.9 tn stimulus package and the Fed provided an improved growth outlook for the US in 2021. GDP revised up to 6.5% for CY21 (earlier 4.2%) and CPI to 2.4% for 4QCY21 and >2% for CY22-23. We tilt a notch OW on the USD as currency markets world over seem to be pricing in some sort of a risk-on sentiment, with the US and its soaring twin-deficits appearing the ideal “risk-haven”. The apparent carry return from spiking US yields makes us turn a notch OW on the greenback vs. the INR.

Flight to risky USD: Soaring US twin deficits push yields and potentially, USD carry…

Source: Bloomberg

TACTICAL ASSET ALLOCATION (TAA) VIEWS & PERFORMANCE

Source: Bloomberg. Assuming a 6% annualized yield for cash.

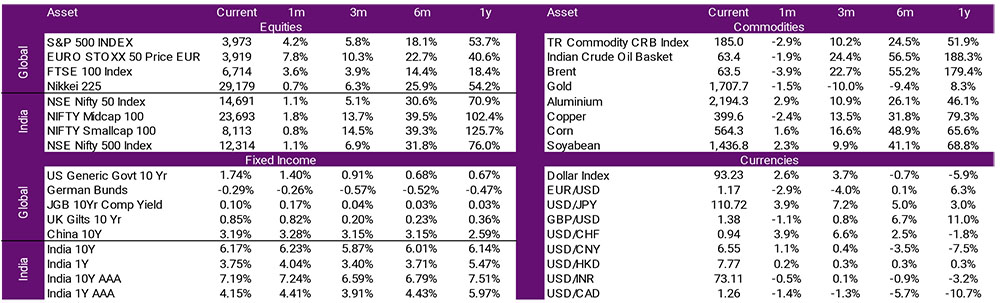

GLOBAL ASSET PERFORMANCE SNAPSHOT

Source: Bloomberg Equity/Fixed Income Returns/Yields in local currencies. Commodities in USD. Numbers for Fixed Income are Yields. As of 31st March 2021.

ROUTES TO MARKETS: MODEL ALLOCATIONS