This time last year the world was getting locked down to flatten the curve. Finally, we seem to be in a much better place with dropping daily infections and rising vaccinations.

GLOBAL MACRO: VACCINATIONS AIDING QUICK RETURN TO NORMALCY

This time last year the world was getting locked down to flatten the curve. Finally, we seem to be in a much better place with dropping daily infections and rising vaccinations. If the rollout continues apace, much of the advanced world would develop herd immunity by mid-2021. This could drive large-scale re- openings and unleash pent-up demand. The hard-to-believe stimulus checks have boosted personal savings and rallying equity markets have enhanced household net worth. Though, global manufacturing PMIs moved into expansion zone early on, the services sector has been a laggard and would blast-off from here. It is a dynamite-meets-gunpowder situation. Such strong momentum has led to global GDP growth forecasts of 5.1% for 2021, with EM, fronted by China and India leading the way. One gloomy spot is the still elevated jobless claims and unemployment levels. The hope is that businesses will also invest in people alongside machinery as they see the trends sustaining for a few more months leading to revival in animal spirits.

GLOBAL EQUITIES: INFLATION WORRIES OVERBLOWN; OW EU/JAPAN

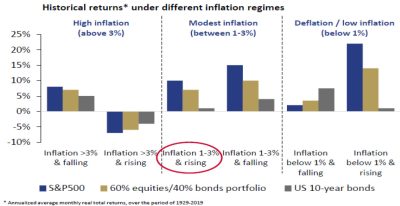

World over, stock markets have been witnessing a recurring theme in recent months. Sudden spike in volatility is seen in one of the four weeks leading to sharp drawdowns and utter chaos. Blame was on GameStop in Jan-21 and inflation bore the brunt in Feb-21. When markets are at elevated valuations and participants are sitting on huge profits, such sporadic irrational behaviours are a common occurrence. As economies are reverting to pre-Covid levels, demand has improved, but with supply chains yet to normalize, prices for many goods are on the rise. Reflation is consistent with recovery phase of the cycle and, at present, most metrics of core inflation remain well-anchored below 2%. The fear is global services inflation will accelerate when pandemic pressures ease and that has led to surging inflation expectations. But equity investors should not get swayed by reflation as it is different from runaway hyper-inflation. In the former, some corporates can pass on higher input prices to their consumers unlike in the latter case. Organised players fall in this category and they are rather able to protect their operating margins and gain market share.

Value and Cyclicals are favoured compared to Growth and Defensives at the current juncture which is further supported by their better EPS growth. Hence, retain tactical OW stance on EU/Japan (Value) and stay Neutral US (Growth).

Current inflation regime favours an equity-only portfolio

Source: Goldman Sachs, LGT

GLOBAL FIXED INCOME: MEAN REVERSION; OW HIGH YIELD

The massive $1.9tn (could be watered down to $1.4tn) American “Rescue Plan” is in the last stages of passing the Senate. No doubt it will add to the already bulging fiscal deficit but will also aid recovery as many of the existing stimulus benefits come to an end this month. Both the current and ex-Governor of US Fed reiterated their support for ultra-accommodation and easy policies. Major central banks have kept their guidance on asset purchases unchanged stressing that they are in no hurry to taper down as economy remains “far from the goals” of substantial progress on employment and inflation. Nevertheless, the yield curves have steepened globally pricing in higher inflation expectations and incremental debt. We could take solace from what S&P Global stated – rising yields still “a World away” from impacting sovereign ratings. We retain our tactical OW on HY bonds relative to IG and Sovereign bonds.

Global 10Yr Sovereign yields spooked by inflation expectations

Source: Bloomberg

GLOBAL COMMODITIES: RED HOT; OW GOLD BUT LESSEN CONVICTION

US oil production dropped MoM since the storm began hitting Texan production facilities in mid-Feb-21. OPEC+ has also stayed put on production levels for Feb and Mar-21. Supply constraints and demand revival boosted Oil prices by 18% MoM. Copper bounced 15% MoM as it corroborated broad economic resilience and its importance in green energy transition. Gold fell ~6% MoM driven by declines in ETF holdings, even as consumer demand witnessed traction. While spiking US bond yields pushed up volatility, and gold is typically a safe-haven asset – this time around much of the liquidity could have rotated into cryptos. However, we retain a (slightly lesser) OW stance on Gold.

US+OPEC Oil Supply (Mn barrels per day) Remains Well in Check

Source: Bloomberg

INDIA MACRO: HEADED IN THE RIGHT DIRECTION

The Indian economy has returned to growth from the pandemic-induced technical recession with a quarterly expansion of 0.4% in Q3FY21, driven by a strong revival in agriculture (3.9%) and industry (2.7%). This provides further confidence in the expectation of a swift domestic economy revival. The Dec-20 ending quarter also witnessed traction in both private consumption and government expenditure as well as investment activities (GFCF – 5.9%). The gradual reopening of the economy coupled with pent-up demand stimulated consumption and activities across sectors. While the number of active Covid- 19 cases has seen an increase in various states led by Maharashtra and Kerala, vaccinations are now underway, with more than 15 million doses administered across the country. In a bid to increase the rate of vaccination, the government has now permitted citizens to get vaccinated at private and public hospitals 24×7 and reiterated that there is no shortage of the vaccine.

Automobile OEMs reported a healthy performance for Feb-21 with Tractor, PV and CV volumes witnessing growth. Tractor volume continued to be robust, with higher reservoir levels and sustaining agriculture growth. High-frequency indicators for Feb-21 like GST Collections, FASTag toll collection and E-way bill generation came in healthy. Even Manufacturing and Services PMI are in expansion zone for 6 months in a row now. The last week of Feb-21 also saw a strong improvement in mobility to workplaces, while mobility to retail, grocery/pharma and transit stations were stable.

FY21 GDP revised slightly downwards to -8.0% vs -7.8% earlier

Source: GoI

Retail and Recreation has recovered to ~80% of pre-Covid levels

Source: Google Mobility Report

INDIA EQUITIES: CYCLICALS BEAT DEFENSIVES; OW EQUITY / MID CAPS

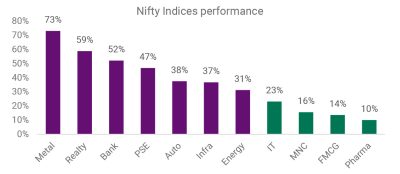

The spectre of inflation and related concerns about higher interest rates (and thus attractive bond yields) forced the bulls to go on the back foot globally, and India was no exception. But India has been an eternal story of market share moves from unorganised to organised businesses. The pandemic rather quickened this transition by several years. With commodity prices buoyant and lower base effect, some sectors could witness gross margin pressures in coming quarters, but companies with pricing power are more likely to sustain their operating margins. It will be prudent to separate the wheat from the chaff and focus on bottom-up stock picking. Headline index could dilly-dally due to elevated valuations and the fear of tapering liquidity in the face of rising inflation. But it would also lead to healthy consolidation and exit of weaker hands making the journey less volatile after that for long-term investors. One concern is heavy supply via IPOs in 2021 as promoters turn opportunistic.

Retain our OW stance on Equity taking confidence from resilient economic recovery and upbeat management commentary and guidance. Expensive valuations are balanced by unending liquidity and low real bond yields. We also maintain our OW stance on Mid vs Large-caps led by strong earnings growth and retail participation but lessen conviction due to mixed technical indicators.

As stated earlier, satellite positions could be considered in short term thematic opportunities like PLI, Infrastructure, Value with a 6–12-month view.

Cyclicals and Value have outperformed Defensives post US elections

Source: Bloomberg, Indices performance between 30-Oct-20 and 03-Mar-21, PSE: Public Sector Enterprises, MNC: Multi-National Corporations

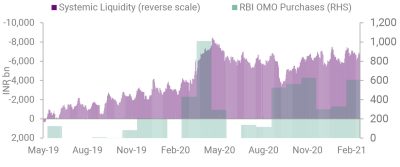

INDIA FIXED INCOME: A BALANCING ACT; OW CORP / SHORT-TERM

The RBI stayed put with its accommodative stance and kept rates on Hold at its 5-Feb-21 MPC meeting. It lowered its inflation forecast for 4QFY21 and raised it for 1HFY22 opening room to remain supportive of growth. The RBI finds itself between a rock and a hard place as it tries to balance growth and inflation. Too much liquidity poses risks to input prices and tapering it sooner could derail the growth engine. Higher inflationary expectations are feeding into benchmark G- Sec yields from where the corporate bond curves are derived. In the Governor’s own words, “yield curve is a public good” and all must ascertain its “orderly evolution” to ensure government’s huge borrowing plan flows smoothly and spurs post-pandemic growth. RBI feels market participants have misconstrued its crisis-mode normalisation measures as a “change in stance” and pushed up yields especially on the medium-long term to year ago levels. One could argue that investors have finally won the fight in demanding fair values commensurate to the higher-than-expected fiscal deficits. We retain our view of avoiding G-Secs and long end of curve with focus on top quality corporate issuances / funds and short duration investments in debt portfolios.

INR 60k Cr. OMOs in Feb-21 not enough to reign in yields

Source: Bloomberg

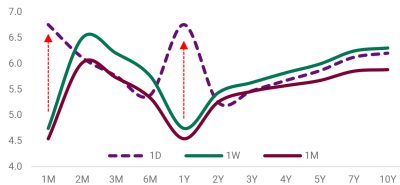

CURRENCY: LIQUIDITY REPLACES INTEREST RATES AS FUNDAMENTALS

While the Budget showcased India as a China+1 alternative, FIIs however begged to differ per equity flows. Excluding the inter-promoter Bosch deal of ~INR 30k Cr. as well as ~8-9k Cr. of MSCI buying, FIIs were net sellers in Feb-21. RBI would have likely heaved a sigh of relief at not having to suck out excess FII liquidity and consequently, the INR did weaken. Striking while the iron is hot, the RBI went a step further and passed on the baton of USD buying from itself to other banks. It exempted foreign banks set up in India from their LEF exposure limits on foreign currency, effectively allowing these banks to purchase the USD. FDI flows into India due to the PLI scheme should continueunabated but dwindling FII flows and the LEF tweaks could likely prevail and lead to an INR depreciation in the near-term. We turn tactically OW on USD while acknowledging the likely medium-term weakness from rising US twin deficits.

MIFOR (%) spiked up for 1M & 1Y tenures likely on USD buying

Source: Bloomberg

TACTICAL ASSET ALLOCATION (TAA) VIEWS & PERFORMANCE

Source: Bloomberg. Assuming a 6% annualized yield for cash.

GLOBAL ASSET PERFORMANCE SNAPSHOT

Source: Bloomberg Equity/Fixed Income Returns/Yields in local currencies. Commodities in USD. Numbers for Fixed Income are Yields. As of 28th February 2021.

ROUTES TO MARKETS: MODEL ALLOCATIONS