In-sync with consensus, repo rate unchanged at 6.5%; tone maintained as calibrated tightening; CPI expectations lowered. We think, rate hike cycle is behind us for now. Dovish stance likely in next meet on sustained Oil price weakness.

Monetary Policy Review Dec-18

In-sync with consensus, repo rate unchanged at 6.5%; tone maintained as calibrated tightening; CPI expectations lowered. We think, rate hike cycle is behind us for now. Dovish stance likely in next meet on sustained Oil price weakness.

KEY HIGHLIGHTS

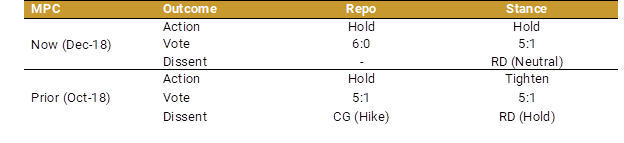

- Voting consensus

Note: PD: Dr. Pami Dua, CG: Dr. Chetan Ghate, MP: Dr. Michael Debabrata Patra, VA: Dr. Viral V. Acharya, UP: Dr. Urjit R. Patel, RD: Dr. Ravindra H. Dholakia

- The next meeting of the MPC is scheduled from 05- 07-Feb19.

- Global economic health weak: The U.S. and the Euro area weakened on trade tensions and political uncertainties in the latter. U.S. markets sold off on corporate earnings growth concerns. Emerging economies like China and Russia also lost traction due to weak demand and trade worries.

- Domestic economy broadly stable: Q2FY19 real GDP growth slowed to 7.1% yoy weighed down by moderation in private consumption (on subdued kharif output) and a drag from net exports. However, gross fixed capital formation (GFCF) expanded by double-digits for the third consecutive quarter, driven by the GOI’s infrastructure impetus, reflected in strong cement production and steel consumption. Further, encouragingly, capacity utilization at Q2FY19 stood at 76.1% vs. Long Term average of 74.9% and PMIs have remained in expansion mode.

- Real GDP:Going forward, lower rabi sowing may adversely affect agriculture and rural demand. However, Crude weakness, increasing Capacity Utilizations boosting corporate earnings and virtual closing of the output gap keep growth projections of the RBI largely unchanged vs. last MPC meet.

Source: MPC Policy Statement, Dec-18

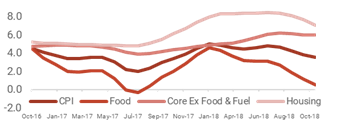

- Significant inflation cooling: Softening Crude and a large deflation in food prices (mainly vegetables, pulses and sugar) offset the increase in inflation in the items ex. food and fuel sub-basket. As a result, CPI in Oct-18 came in at 3.3% vs. 3.7% in Sep-18.

CPI Trajectories (% yoy)

Source: RBI

- Inflation expectations of households’ survey:

Source: MPC Policy Statements

- MPC forward estimates of CPI:

Deflation in food commodities contributed to a significant tempering of CPI expectations for H2FY19. Secondly, the collapse in price of Indian crude basket to below $60/bbl by Nov-18 after touching $85/bbl in early Oct- 18 further softened estimates. Also, the effect of revision in minimum support prices (MSPs) announced in Jul-18 has been subdued so far.

Source: MPC Policy Statements

- Liquidity update: RBI injected durable liquidity amounting to INR 50k Cr. in Nov-18 through OMO purchases, bringing total durable liquidity injection to INR 1.36 trillion in FY19. They have a planned OMO of INR 40k Cr. for Dec-19 and are expected to continue till Mar-19. Liquidity injected under the LAF, on an average daily net basis, was INR 56k Cr. in Oct-18, INR 80.6k Cr. in Nov-18 and INR 10.5k Cr. in current month. Further, the RBI has assured to be on stand by for both short term and durable systemic liquidity infusion going forward.

Systemic Liquidity & RBI OMO Purchases (INR Cr.)

Source: Bloomberg

- Market Reactions: